A very ugly session on Wall Street yesterday failed to trigger the patterns one would expect in the major and minor currencies, as emerging-market currencies and the commodity dollars continued to pull higher yesterday against the super-majors. Even the JPY crosses couldn’t manage to sustain much of a consolidation lower. It’s tough to conjure up an explanation for the market’s movements here: perhaps the market believes in stronger global recovery prospects, meaning more central bank tightening.

The mentality could be that we should reprice the most liquidity-driven, high risk assets and place money in the economies with better growth prospects and higher yields, but normally liquidity/tightening fears of this nature also lead to weakening in the less liquid currencies as well, in line with weakness in risky assets like stocks. Let’s see if the pattern holds in the event we get a significant extension lower in stock prices. One pattern is very clear here: the major European currencies are looking extremely weak against the AUD, NZD and even CAD now, after almost 18 months of these providing some of the G10’s most compelling trends. GBPCAD in particular is an interesting case study at the moment, as outlined below.

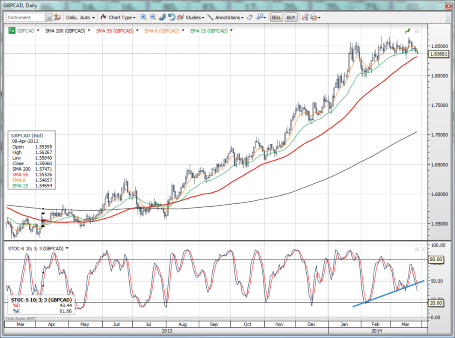

Chart: GBP/CAD

GBP/CAD was perhaps the G10’s most persistent trender over the last year before losing momentum in recent weeks. Now the pair appears poised for a larger consolidation lower as downside momentum is picking up speed.

NZD/USD is pushing at cycle highs again after a strong trade balance report late yesterday. This also triggered a significant reversal (with a significant delay) in AUD/NZD.

The St. Louis Fed’s James Bullard was out speaking in Asia and says that Fed suspension of its reinvestment policy (to maintain the size of its balance sheet) is an option. Bullard is not on the Federal Open Market Committee this year so let’s see the Fed taper purchases to zero before we start talking about suspension of reinvestment.

Looking ahead

The Norges Bank meets today to decide on rates. The market has no expectations for developments around this meeting, leaving the bar rather low for a surprise which could come in an adjustment of the bank’s forward policy forecasts. The bank will not likely ring the alarm bell on deflation as the CPI remains elevated relative to mainland Europe and elsewhere.

With the euro performing so weakly against the commodity dollars in recent days, I’m not sure what could drive EUR/NOK any higher unless risk appetite or oil prices weaken severely or we get an unlikely dovish turn in Norges Bank guidance. The weak risk appetite in the US late yesterday and overnight showed us that at least the commodity dollars/emerging market currencies and risk appetite are not moving in synch at all at the moment. Looking at relative rate developments and long term valuations, NOK/SEK sticks out like a sore thumb, as Swedish rates have pushed ever lower of late while Norwegian rates have ticked back higher the last couple of months.

Chart: NOKSEK

NOK/SEK has staged a local comeback after consolidating the previous sharp rally off the lows. From here, as long as the Norges Bank supports, we may be looking at a test of the 1.0750 area, where the 200-day moving average comes in, and then on to 1.0900 plus.

UK releases its latest retail sales report, which we’ll have to take with a grain of salt after highly disruptive weather this winter in the British isles, though a strong report therefore is of more interest than a weak one for the same reason. The US sees yet another revision to Q4 growth figures for those interested in the distant past. Otherwise, we only have US weekly claims and pending home sales on the docket for the US today.

US FOMC voter Sandra Pianalto will be out speaking in early US hours today.

A raft of Japanese data is out overnight, including employment, spending and inflation figures that could get considerable attention on any significant surprises as we head into a new financial year next Tuesday in Japan. EUR/USD must move and very soon as the pair looks heavy, but let’s see if we can take out that 1.3750/75 zone today.

Economic data highlights

- New Zealand Feb. Trade Balance out at +818M vs. +600M expected and +286M in Jan.

Upcoming economic calendar highlights (all times GMT)

- Norway Norges Bank Deposit Rate Announcement (0900)

- Norway Norges Bank’s Olsen Press Conference after rate decision (0900)

- UK Feb. Retail Sales (0930)

- UK BoE published financial policy committee statement (0930)

- US Fed’s Pianalto to Speak (1230)

- US Q4 GDP revision (1230)

- US Weekly Initial Jobless Claims (1230)

- US Weekly Bloomberg Consumer Comfort Survey (1345)

- US Feb. Pending Home Sales (1400)

- Us Mar. Kansas City Fed Manufacturing (1500)

- Japan Feb. Overall Household Spending (2330)

- Japan Feb. Jobless Rate (2330)

- Japan Feb. National CPI (2330)

- Japan Feb. Retail Trade (2350)

- Japan Feb. Large Retailer’s Sales (2350)

- UK Mar. GfK Consumer Confidence (0005)

- US Fed’s Tarullo to Speak (0020)

- US Fed’s Evans to Speak (0130)