In this week's market analysis, we will look at potential trading opportunities and zones where we should look for price action, evidence and potential moves.

Pairs and markets analyzed this week: AUD/NZD, AUD/USD, Gold, USD/JPY

AUD/NZD: At 1st management point (3.5 ROI)

As mentioned last week we were waiting for bullish evidence (significant price action) for a potential move to the upside the support zone.

We entered the trade on a very nice significant pinbar (Aug 2nd) and we are now at 2.8 ROI and approaching our 1st management point ( the 1.073-1.077 zone). If price breaks this zone it could go as high as the next resistance zone (1.123-1.129).

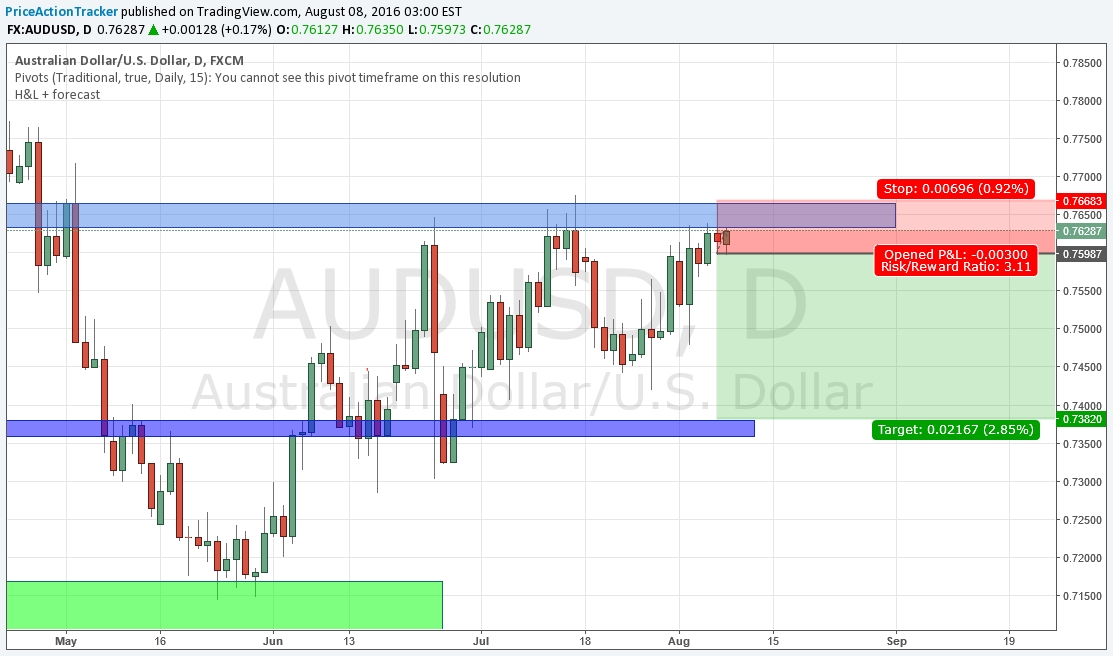

AUD/USD: Significant pinbar price action at resistance zone

Significant pinbar price action at resistance zone 0.763-0.767. Potential move to the downside from this zone.

Target: 0.738 for a 3.11-1 ROI

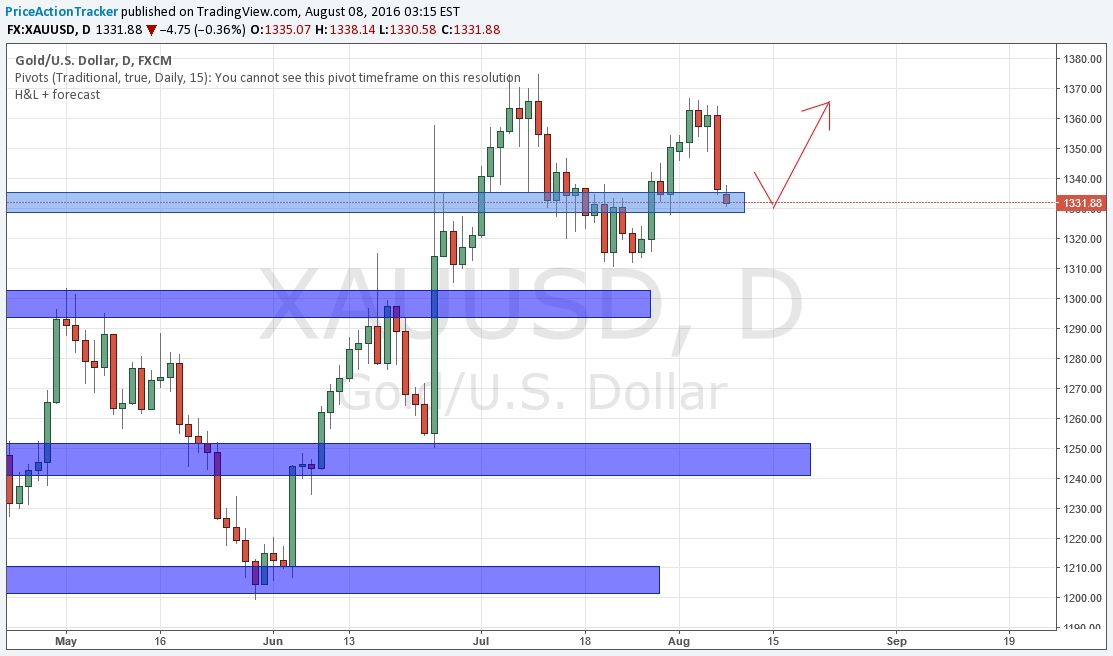

Gold: Testing support. Watch out for bullish price action

Gold price is at support zone 1328.9-1336.3. Watch out for bullish evidence (significant price action) and a potential move to the upside from this major zone.

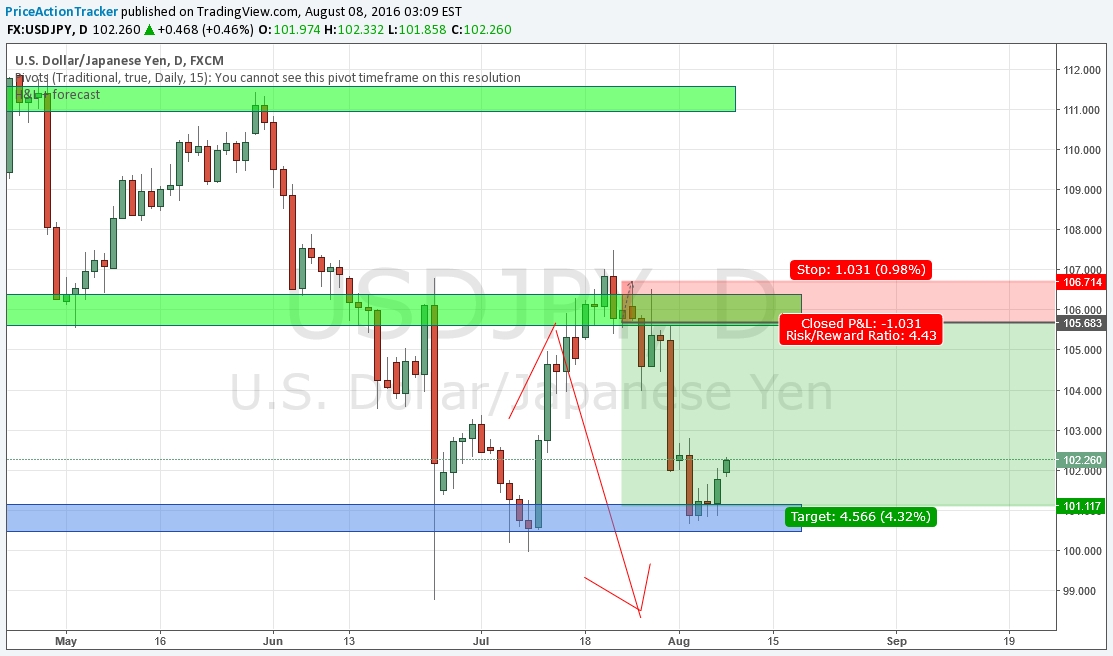

USD/JPY: A nice 4.43 ROI thanks to nice price action at resistance

For those who went short 2 weeks ago on this bearish price action pinbar, we were aiming for 101.2 and turned a nice 4.5:1 ROI.

Disclaimer: This is educational and general information only (not advice or a recommendation). Trading financial instruments, including Stocks, Futures, Forex or Options on margin, carries a high level of risk and is not suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in financial instruments or foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that your losses can exceed deposits and therefore you should not invest money you cannot afford to lose. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. Past performance, whether actual or hypothetical, is not necessarily indicative of future results. All depictions of trades whether by video or image are for illustrative purposes only and not a recommendation to buy or sell any particular financial instrument. See full risk disclosure. By viewing this site's Content or Videos you agree to the Privacy and Disclaimer.