In the post-FOMC environment, BNP Paribas (PARIS:BNPP) FX Positioning Analysis highlights some significant potential in FX markets in the final three months to year-end.

"Positioning appears completely inverse to our expectations and thus presents considerable potential for market adjustment if our economic and market scenario pans out. Typically, FX positioning tends to build during Q4," BNPP argues.

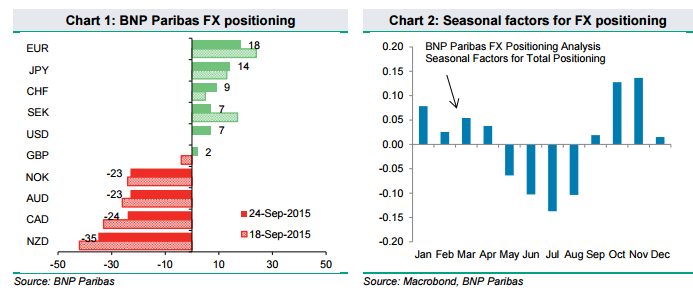

BNPP latest Positioning Analysis classifies current FX positioning into 3 clear groups:

Neutral: USD and GBPusd.

"We believe that sharp policy divergence in December will prompt a significant move lower in EUR/USD as such expectations become fully priced by the market. Specifically, we forecast that the FOMC will hike rates in December while the ECB eases policy further (by extending monthly asset purchases under its QE programme). Neither is fully priced by markets. Such simultaneous policy divergence is unusual and will likely push EUR/USD lower towards our 1.06 year-end target," BNPP projects.

"GBP is another currency that could perform strongly given the dislocation between our view and the current market expectations for the Bank of England (BoE). We believe that the BOE will start hiking in February and will hike six times (at 25 bps clips) during 2016/17. In contrast, markets price August as the start of the hiking cycle and only four hikes during 2016/17. With positioning close to zero (the market was short until recently) GBP has the potential to rally substantially as markets adjust," BNPP adds.