We close our 3M EUR/GBP seagull before time with a 0.64% profit.

In FX Trends: Trust your central banker, published on 20 August, we recommended entering a 3M EUR/GBP seagull on an expected slow and steady move lower in the cross.

During August and September, we saw support to sterling from very strong UK numbers, not least from the UK housing market. However, we now believe the risks to sterling have become much more two sided.

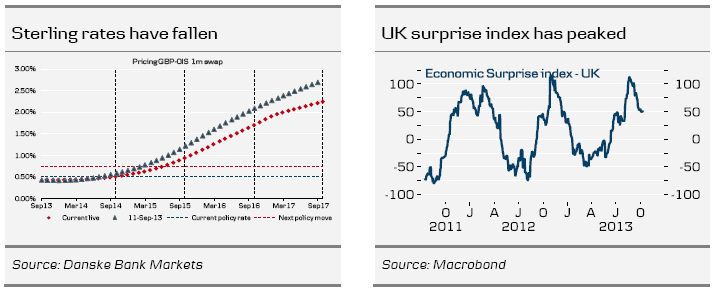

1. The UK surprise index now seems to have peaked. Today, we saw disappointing industrial production data.

2. The market has once again postponed the expected timing of the first rate hike from the Bank of England. We see a risk that rate hike expectations could be scaled back further if we see more negative surprises.

3. Currently, we see broad support to the euro from better performances for peripheral bonds, the upward pressure on short-dated EONIA rates due to a tighter liquidity situation in the euro area and a less dovish Mario Draghi at last week’s ECB meeting.

We have, therefore, decided to close the strategy before time and earn the profit especially from the bought put with a 0.8470 strike. The sold 0.8700 call and the sold 0.8200 put can be bought back only with a small loss. All in all, the strategy can be closed with a profit of 0.64% (spot ref. 0.8467).

Note that our 6M USD/JPY risk reversal initiated on 22 March expired in September with a 0.9% profit (spot ref. 98.85).

See overleaf for an overview of our FX trades.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FX Position Update - Close EUR/GBP Seagull With A 0.64% Profit

Published 10/10/2013, 02:49 AM

Updated 05/14/2017, 06:45 AM

FX Position Update - Close EUR/GBP Seagull With A 0.64% Profit

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.