Don't be fooled by the apparent indecision in some currency pairs while we see the others moving to fresh 2019 extremes. Such an action smells of cashing profits and identifying new trading setups, which is exactly the subject of today's Alert.

EUR/USD - Consolidating

We wrote in our yesterday's commentary that while:

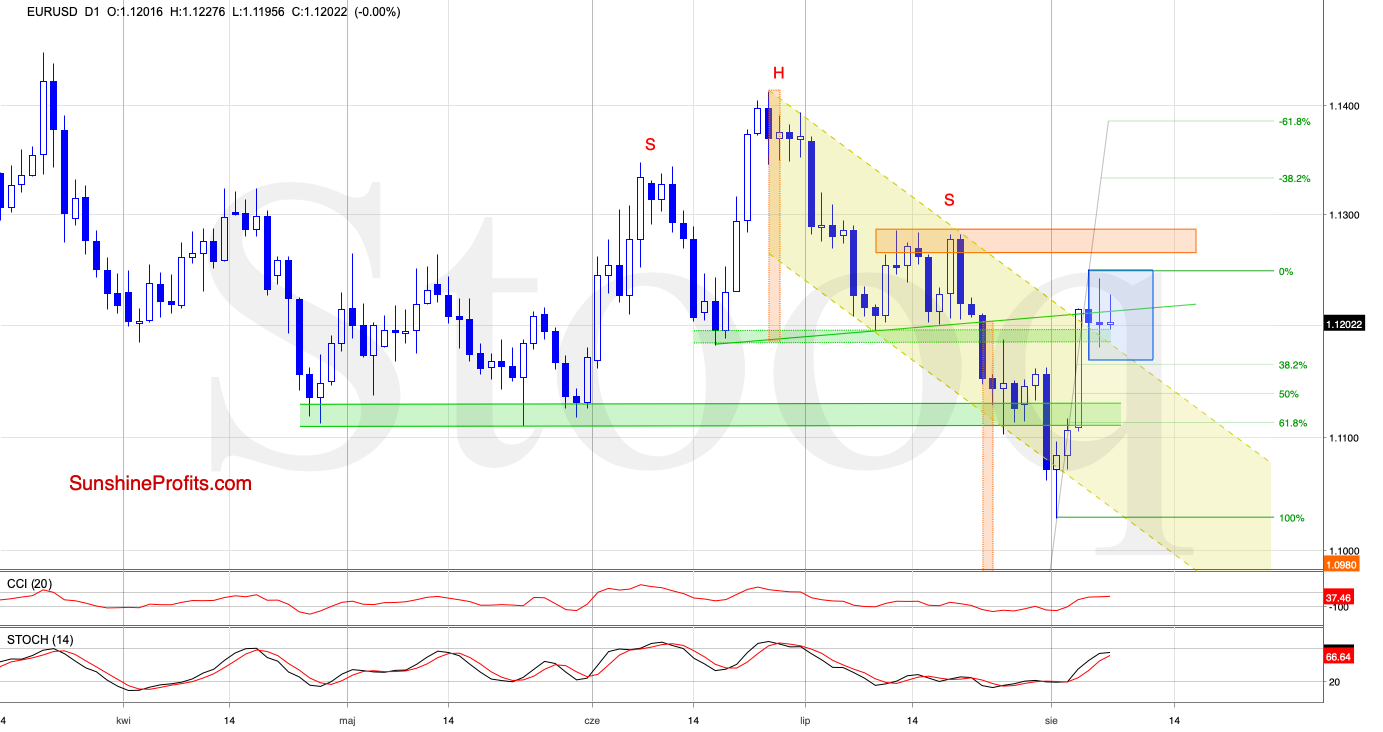

(...) the exchange rate moved below the upper border of the declining yellow trend channel, suggesting that we'll see a test of the 38.2% Fibonacci retracement in the very near future.

Nevertheless, the buy signal generated by the Stochastic Oscillator suggests that the bulls will defend this support.

The bears didn't have much success yesterday. The overall situation in EUR/USD hasn't changed much as the exchange rate is still trading sideways inside the blue consolidation.

USD/CAD - About to Roll Over?

USD/CAD extended gains in previous days, climbing not only above the orange resistance zone, but also above the 50% Fibonacci retracement and the upper border of the green rising trend channel.

Nevertheless, the current position of the daily indicators suggests that the space for gains is limited and reversal in the very near future should not surprise us. This is especially so when we factor in that the 61.8% Fibonacci retracement and the red gap are not far from current levels and could trigger reversal in the following day(s).

Should we see such price action and signs of the bulls' weakness (such as an invalidation of the breakout above the upper border of the green channel), we'll consider opening short positions.

AUD/USD - Making New 2019 Lows

AUD/USD extended losses, dropping below the lower border of the short-term declining grey trend channel during recent sessions. This decline extended beyond the early 2019 low.

Despite this bearish omen, the drop was only short-lived. The buyers took the pair back into the declining grey trend channel, suggesting that we'll see a test of the previously-broken lower border of the declining red trend channel in the very near future.

This scenario is also reinforced by the current positions of the daily indicators - the Stochastic Oscillator generated a buy signal, while the CCI is very close to doing the same.

Should the pair extend its gains and should the bulls be strong enough to invalidate last week's breakdown below the declining red trend channel, we'll consider opening long positions.

Summing up the Alert, the euro is still trading inside its recent consolidation, and no new positions are justified right now. The USD/JPY and USD/CHF commentaries are reserved for our subscribers. We're keeping an eye on the opportunities in the making in USD/CAD and AUD/USD - for now, no action is justified. Apart from these, there're no other opportunities worth acting upon in the currencies.