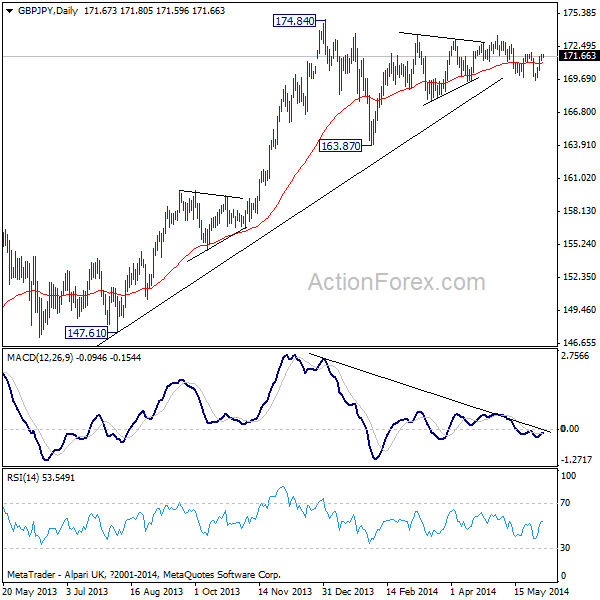

GBP/JPY Daily Outlook

Daily Pivots: (S1) 171.35; (P) 171.57; (R1) 171.89;

Intraday bias in GBP/JPY remains neutral first. As long as 171.97 resistance holds, deeper decline is still expected. Such fall is possibly part of the consolidation from 174.84. Break of 169.50 will confirm this case and target 167.77 and below. Meanwhile above 171.97 resistance will invalidate this bearish case and turn focus back to 173.46 resistance again.

In the bigger picture, the up trend from 116.83 (2011 low) might still extend to above 174.84. Nonetheless, upside momentum is rather unconvincing as seen in weekly MACD. Thus, even in that case, we'd expect strong resistance from 50% retracement retracement of 251.09 to 116.83 at 183.96 to limit upside. Meanwhile, sustained break of 163.87 support should confirm medium term topping at 174.84 and bring deeper correction to 147.61/156.77 support zone next.

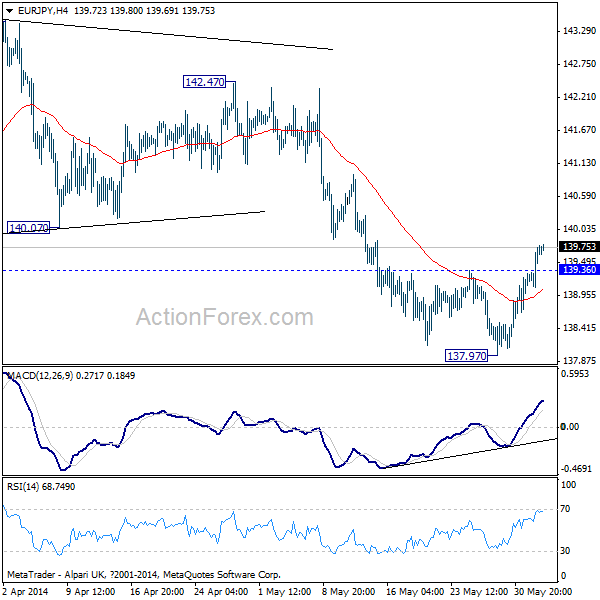

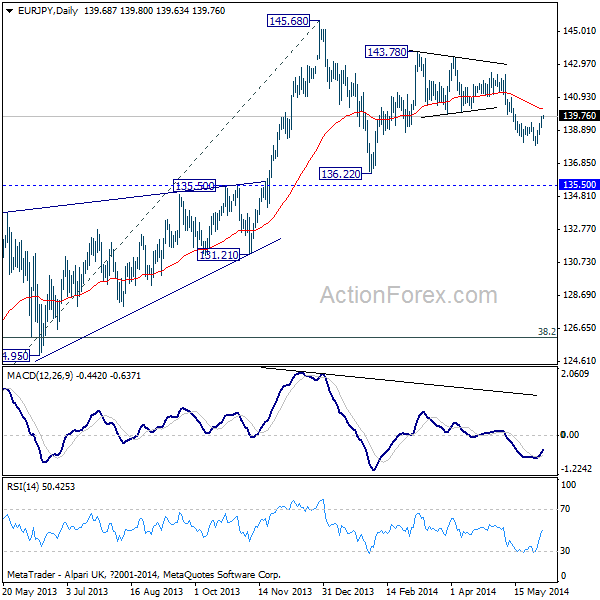

EUR/JPY Daily Outlook

Daily Pivots: (S1) 139.26; (P) 139.51; (R1) 139.94;

The break of 137.97 resistance suggests that a short term bottom is in place at 137.97 on bullish convergence condition in 4 hours MACD. Intraday bias is back on the upside for stronger rebound back to 55 days EMA (now at 140.21) and above. Overall, the consolidation pattern from 145.68 is still in progress. Even in case of further rise, strong resistance would likely be seen below 143.78 to bring another decline to extend the consolidations. On the downside, break of 137.97 will extend the fall from 143.78 towards 136.22.

In the bigger picture, loss of upside momentum was seen in bearish divergence condition in weekly MACD. However, EUR/JPY is so far holding above 135.50 key support. Thus, there is no confirmation of trend reversal yet. Break of 145.68 will extend the up trend from 94.11 towards 76.4% retracement of 169.96 to 94.11 at 152.59 before topping. Meanwhile, break of 135.50 will confirm reversal and target 124.95 support.