News And Rumours

- China Jan official services PMI 53.4, lowest in year, last 54.6.

- China Jan official mfg PMI 50.5, as eyed, last 51.0.

- SNB ViceChair Danthine – Would only consider scrapping EUR/CHF 1.20 floor if inflation much higher, less upward pressure on CHF, totally different economic situation, no inflation risk now – Sonntagsblick.

- Australia Dec bldg approvals -2.9% m/m, unch eyed, priv-sector houses -3.4%.

- Australia Jan overall job ads -0.3% m/m, newspapers -1.4%, internet -0.2%.

- Australia Jan TD/MI inflation +0.1% m/m, +2.5% y/y, trimmed mean unch, +2.7%.

- Australia Jan PMI 46.7, -0.9 pt, production 45.2, -3.4, new orders 48.8, +1.0.

Economic Data &Events

- 07:30 Sweden PMI Manuf mm

- 08:00 UK HalifaxHousePrice

- 08:00 Turkey PPI yy

- 08:00 Turkey CPI yy

- 08:00 UK Halifax house prices

- 08:00 Turkey PPI mm

- 08:00 Turkey CPI mm

- 08:00 Poland PMI

- 08:00 Norway PMI

- 08:13 Spain Manufacturing PMI

- 08:30 Czech HSBC Markit PMI

- 08:43 Italy Markit/ADACI Mfg PMI

- 08:48 France Markit Mfg PMI

- 08:53 Germany Markit/BME Mfg PMI

- 08:58 EZ Markit Mfg PMI

- 09:00 SA Total new vehicle sales

- 09:00 SA Total new vehicle yy

- 09:28 UK Markit/CIPS Mfg PMI

- 12:00 Brazil HSBC manufacturing PMI

- 13:00 Czech Budget balance

Markets Today

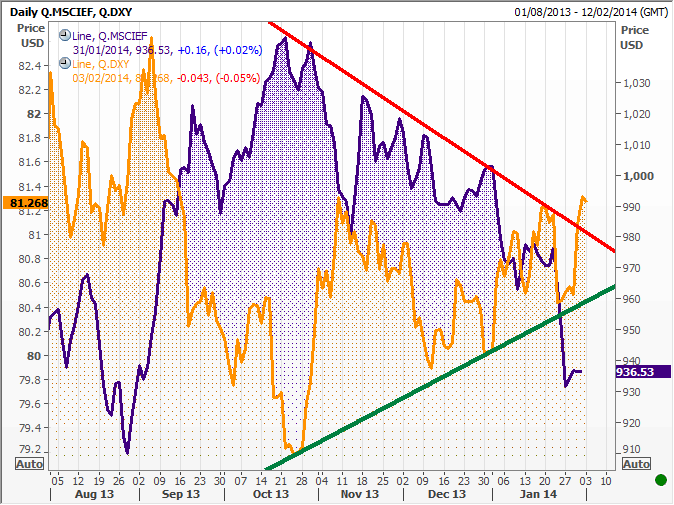

MS Emerging Market Index vs DXY Source:Reuters

Emerging markets selloff is supportive for USD

Macro calendar will be heavy packed on both sides of Atlantic on Monday .European calendar gets underway at 0813 GMT with the release of Spain mfg.PMI .At 00843-0858GMT France ,Italy , Germany and Eurozone mfg PMI will hit the wires.At 0928 GMT UK Markit/CIPS mfg PMI is set for release.NorAm session will the publication of US Markit PMI and ISM for manufacturing sector.

TECHNICAL OVERVIEW

EUR/USD -Bearish. Limited downside

Short term outlook is negative below 1,3550 .Rallies are seen as an opportunity to re -short EUR at better levels .Shorts should target 1,3460 initially and 1,3415/3380 (Fibo support &200D SMA )in extension .Projected range for today 1,3460-1,3540 .

Big picture turned bearish on a daily close below 1,3520 EUR/USD" title="EUR/USD" height="undefined" width="263">

EUR/USD" title="EUR/USD" height="undefined" width="263">

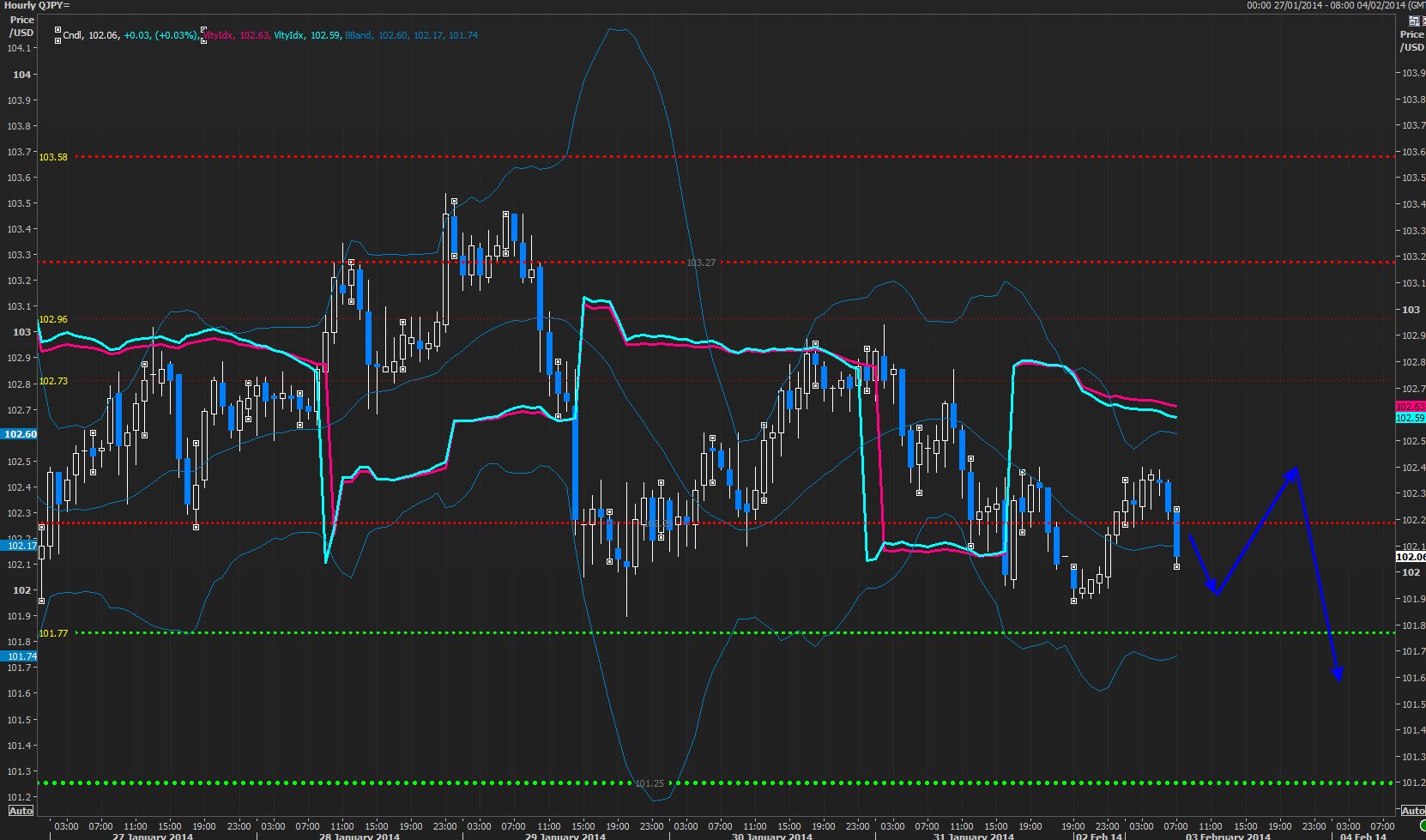

USD/JPY-Bearish.Limited downside

Short term picture is negative below 102.60.Rate is consolidating above daily support at 101,60/70. Rallies should be seen as an opportunity to reinstate shorts for a test of 101,70/60 initially and 101,10/00 in extension .Projected range for Monday

102,50-101,60

Big picture turned bearish on break and daily close below 102,50

USD/JPY" title="USD/JPY" height="undefined" width="263">

USD/JPY" title="USD/JPY" height="undefined" width="263">

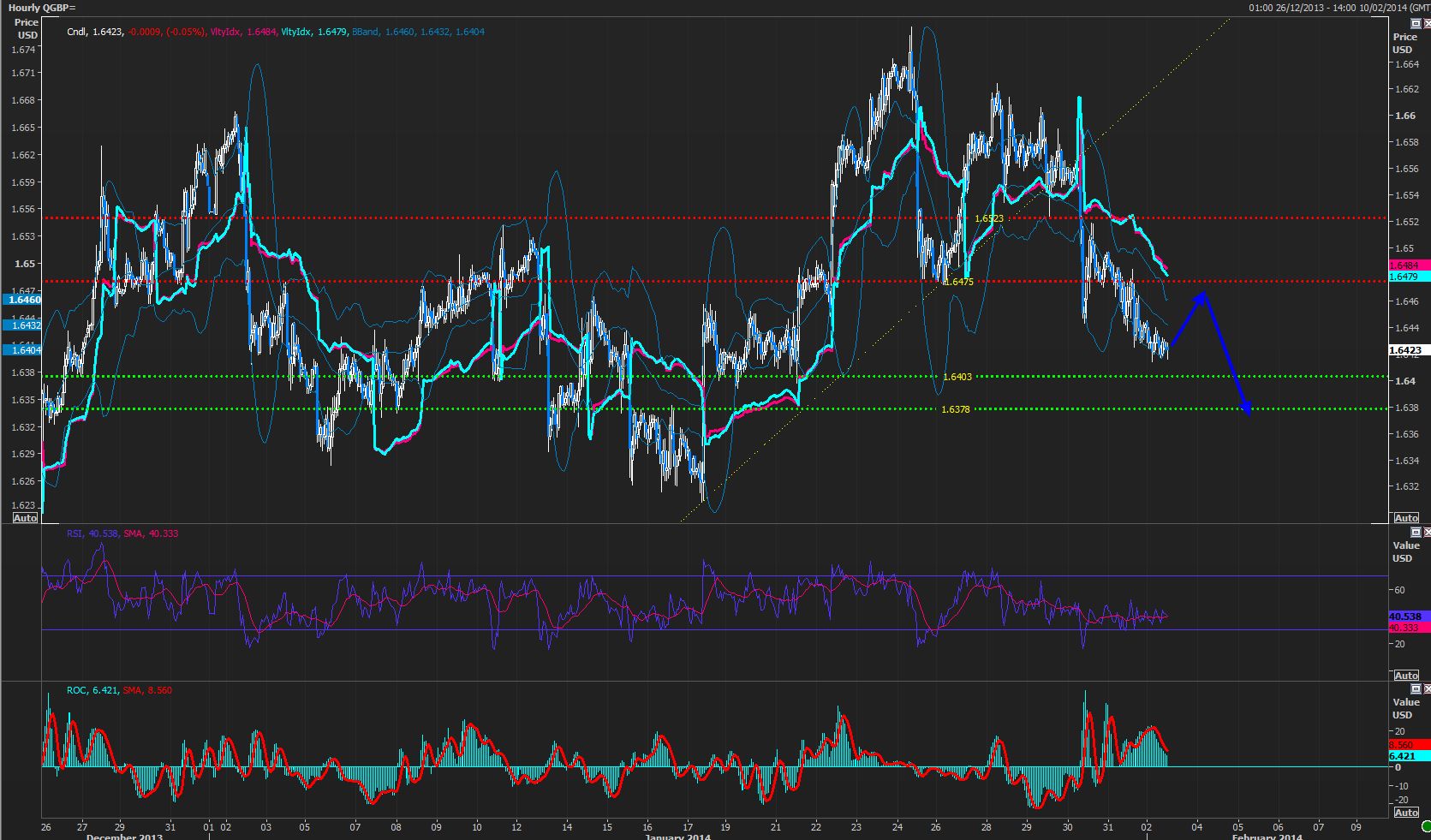

GBP/USD -Bearish .Limited downside

Short term outlook is negative below distant 1,6480 .Rallies are seen as an opportunity to re -short GBP at better levels .Shorts should target 1,6410/6390 initially and 1,6350 in extesnsion .Projected range for today 1,6460-1,6390 .Allow for a period of sideways activity preceding next leg lower.

Big picture remains positive above 1,6300/6280

GBP/USD" title="GBP/USD" height="undefined" width="263">

GBP/USD" title="GBP/USD" height="undefined" width="263">

AUD-Bearish .Limited downside

Short term outlook is negative below 0.8780 .Rallies are seen as selling opportunity for a test of 0,87 initially and 0,8650 in extension .Projected range for today 0,8780-0,8700 .Expect more sideways action in 0,8700-0,88 area before next leg lower

Big picture remains bearish for a test of 0,8550/8500 area

NZD-Bearish Consolidating above key support

Short term picture is negative below 0,8140/0,82 .Intraday market is bit oversold. Corrective rallies should be seen as selling opprotunity for a retest of 0,8080 initially and 0,8050/30 in extension.Projected range for today 0,8080-8140

Big picture is bearish while below 0,8380

EUR/GBP-Bearish.Limited downside

Short term picture is negative below 0,8240/60 .While capped below there is a scope for a retest of 0,8160 .Projected range for today 0.8190-0,8240

EUR/CHF-Bearish .Consolidating above key support.

Short term picture is negative .While below 1,2250 there is a scope for move twds 1,2170/60.Any strenght should be seen as an opportunity to reinstate shorts at better levels . Selling rallies preffered.Projected range for today 1,2240-1,2200

Big picture remains negative below 1,2320

USD/PLN-Limited upside

Short term outlook is positive above broken reisistance at 3,12 .Rate is close to overbought levels both on intraday &daily charts.The rally seems to be a bit overdone .We’d be cautious with setting fresh longs at current elevated levels.We may be close to levels where local top may form. We stick to longs with tight stops.Projected range 3.1250-3,16.

EUR/PLN-Limited upside

Short term outlook is positive above 4.22 Rate is overbought on intraday &daily charts.The rally seems to be a bit overdone.We’d be cautious with setting fresh longs at current elevated levels.We may be close to levels where local top may form.We stick to longs with tight stops.Projected range 4,2250-4,26