The USD Index has weakened 3% since the Shanghai G20 meeting on talks of central bank policy coordination. US real rates have fallen further, with core inflation reaching 2.3% YoY; however, the Fed provided the market with dovish signals, citing tighter financial conditions as a justification for its tone. Interestingly, the Fed acknowledged that recent market turbulence had very little impact on the US economy, suggesting to us that it is willing to take more international responsibility.

So far, achievements of this policy look impressive, and it seems that everybody is winning. EM capital outflows have eased as commodity prices have rallied, global equity prices have recovered, with US markets showing their first year to date gain this year, and China has been able to fix USD/CNY lower while simultaneously allowing its RMB-TWI to move lower, creating the much needed easing of monetary conditions in China.

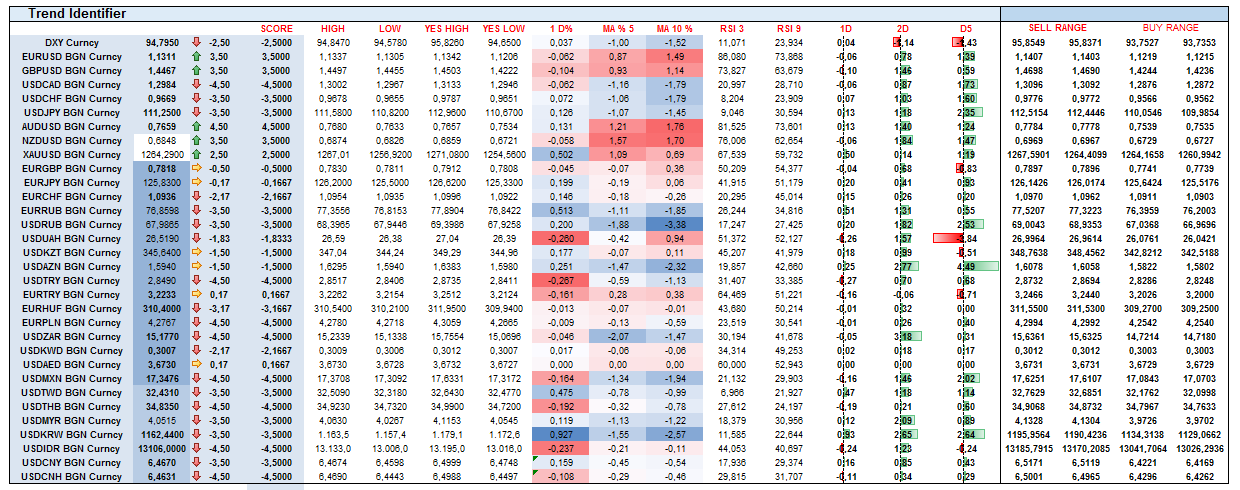

Price action wise, post-Fed USD selling has slowed down but the trend is still strong. This has marked the third week of commodity and emerging markets' strength, and a strong close would only pave the way for further gains across the board. Commodity currencies still lead the way with CAD, AUD, NZD and RUB. Emerging markets are strong as well, with TRY, ZAR, MXN, and THB performing well. The rally seems to be set to continue and profit taking price action should stay shallow.