Overall, the price action has looked like one of disappointment, but it was the EUR/USD move more than anything else that drove the afternoon trading. Most market players, including leveraged funds, have been shorting the EUR on an interest rate differential trade idea. They have been unsuccessfully running these trades for some months now. No more interest rate cuts naturally triggered stop losses in both short EUR interest rate futures and EUR/USD, as ECB changes the way it assaults the low inflation environment. People who have been stuck with old methods are likely to be disappointed.

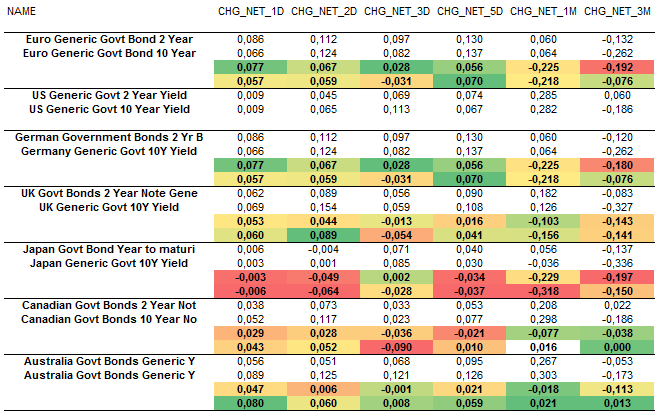

However, when we look at it from a wider angle, we realize this actually is a move in the right direction for European Bank profitability, and I believe it is properly targeted to save the financial industry. The corporate bond buying, even though it is targeted at investment grade and state-backed companies, will provide much better financing options for Eurozone corporates as state-backed corporate debt interest rates are likely to fall fast.

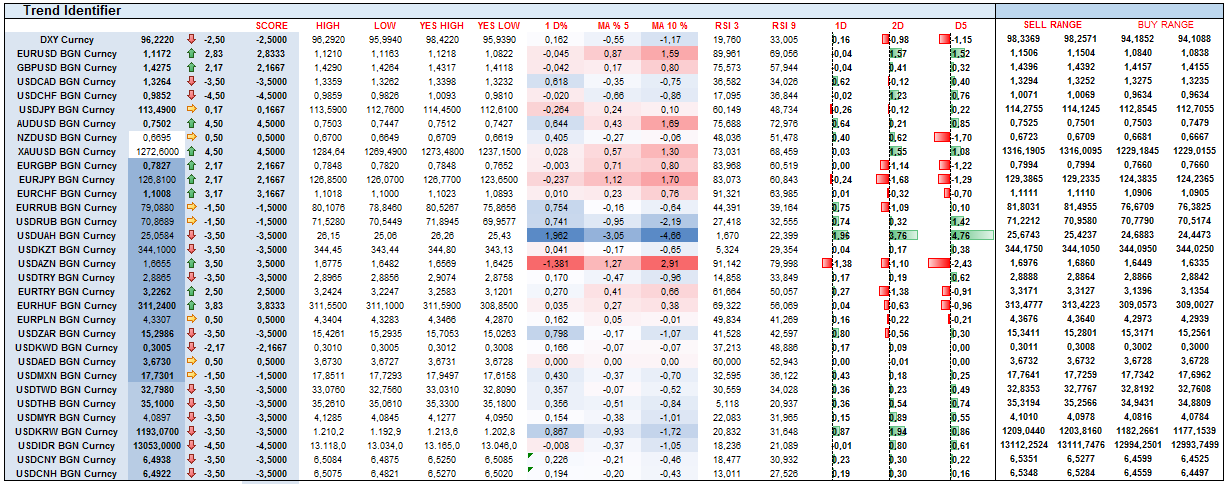

FX has been volatile, and the initial EUR strength triggered USD selling, which in turn triggered a move lower in USD/JPY. The market, confused by the reaction, got on with selling risk, which pushed EMFX and commodity currencies like AUD lower. After all is said and done, we walk in today to find EMFX well supported and holding on to the strength it has established in the last few weeks. AUD, CAD and ZAR are all well bid.

Gold is higher and traded at 1280s, along with all Asian Emerging Markets pushing for strength, including CNY. Credit indexes have performed well and cost of protection kept falling.

It seems after some time the ECB is finally in the right track. I expect European stocks to trade positively the next few weeks, and as EUR/USD positioning gets cleared out in the next few days, the EUR/USD should finally start a reliable trend lower.