In a week that culminates in US nonfarm payrolls, let’s take a look at how the major pairs are shaping up.

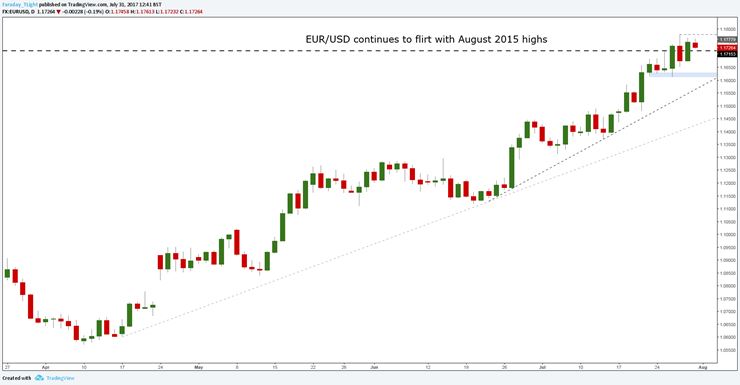

EUR/USD continues to flirt with the August 2015 highs which we highlighted last week.

Whilst Thursday’s ‘false breakout’ high should not be seen as a reversal pattern in its own right, it does become integral to this week’s trading strategy…

A break and close above Thursday’s high is likely to signal another trend continuation push to the upside. Whereas a false breakout of Thursday’s high would create an early entry into a mean reverting counter-trend move.

Sterling’s summer resurgence continued last week as the market pressed up into the July highs.

Much like EUR/USD, cable rejected the highs on Thursday only to bounce back and close higher on Friday, leaving the market in limbo.

Given cable’s bullish series of higher swing lows and Friday’s bullish close, probabilities favour a break above 1.3160. However, the Bank of England’s ‘Super Thursday’ inflation report, rate decision and policy statement combined with Friday’s payroll data should make for a volatile end to the week!

Having topped out at the May highs earlier in the month, USD/JPY has been rotating lower within a choppy descending channel.

Last week’s shake-out in equity markets created the catalyst for USD/JPY to break lower and form a new swing high.

For now, lower timeframe short-opportunities look to be the order of the day - targeting a retest of the June lows.

Last week’s price action saw the Aussie draw two clear lines in the sand heading into tonight’s RBA rate decision.

The first is Wednesday’s low at 0.7878, the second is Thursday’s high at 0.8065.

These two pivot levels have put a short-term ‘cap and collar’ on the market. Given the strength of AUD/USD’s uptrend, any retest of Wednesday’s low is likely to create an attractive buying opportunity. Conversely, a re-test of Thursday’s rejection highs will be monitored very closely.