We take a look at the daily charts of EUR/USD, USD/JPY and USD/CAD to highlight key levels and patterns.

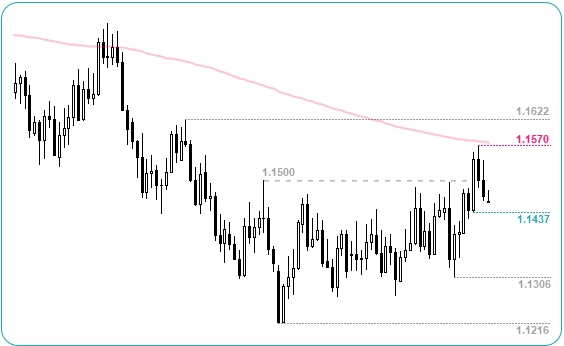

EUR/USD Daily

- Euro’s failure to close above 1.1500 on Friday warns of a bull-trap (and left a bearish hammer on the weekly chart).

- Resistance was found near the 200-day average.

- A break below 1.1437 confirms a 3-day bearish reversal and takes it further within its original range.

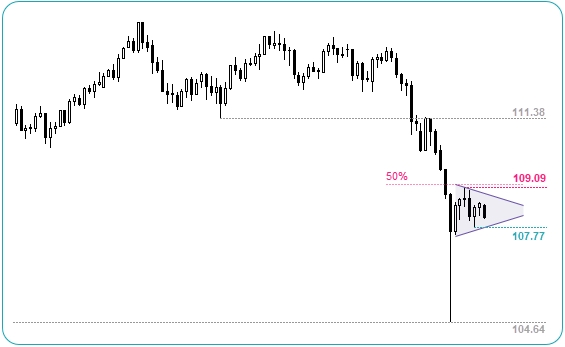

USD/JPY Daily

- A coiling pattern is emerging beneath the 50% retracement level.

- A downside break of 107.77 confirms a bearish continuation.

- A break above 109.09 suggests a deeper retracement is underway. The trend remains bearish whilst below 111.38.

USD/CAD Daily

- The Loonie is beginning to mean revert after an extended sell-off.

- Support was found just above the 100-day average.

- The lower trendline of the broken channel or the 38.2% retracement level are potential areas of resistance for bears to fade into, or bulls to target on lower timeframes.