Investing.com’s stocks of the week

The USD begins the week on the back foot following Friday's reversals. So for today's overview we look at the daily charts for EUR/USD, USD/JPY and AUD/USD.

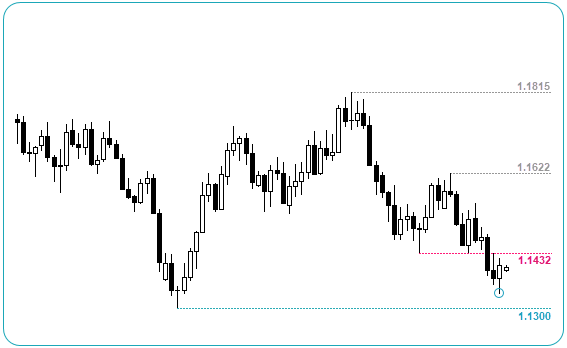

EUR/USD Daily

- Friday’s bullish engulfing candle shows a hesitancy to break lower.

- We need prices to consolidate below 1.1432 before considering a short trade.

- The bias is for a run to 1.13 whilst we trade beneath 1.1432, making it a pivotal level.

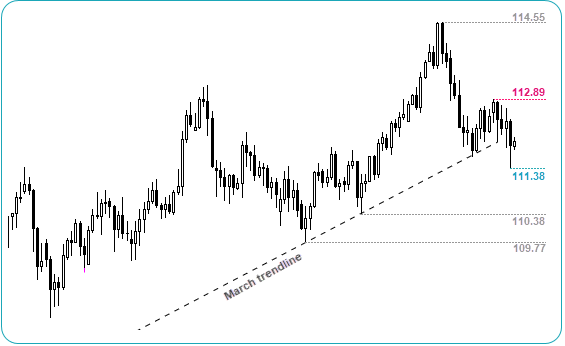

USD/JPY Daily

- Since breaking the March trendline, JPY has started to turn lower.

- 112.89 marks a likely swing high which warns of further downside.

- A break of Friday’s low (111.38) confirms the bearish move is ready to resume.

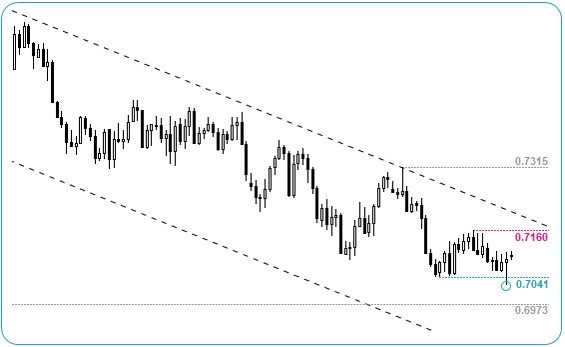

AUD/USD Daily

- An elongated bullish pinbar (which is also an outside day) warns of a bear-trap at the lows.

- Near-term risks are to the upside, although the longer-term trend remains bearish.

- The 0.7160 high and bearish channel are potential targets / areas of resistance for bullish setups.