STOCKS

: The fundamental backdrop is volatile: the US payroll tax increase and “sequestration” are just now putting pressure upon the US economy; China has “dampened” their housing market, and the economic data is showing it; and the Eurozone is seriously contemplating loosening up their austerity plans. For now, the risk-premiums on stocks remains low, but we feel that risk is being mispriced at current levels given recent pressure upon world economic figures and the developing pressure upon

corporate margins/ earnings. The consensus is the Fed and other central banks will save the day with printing; we disagree.

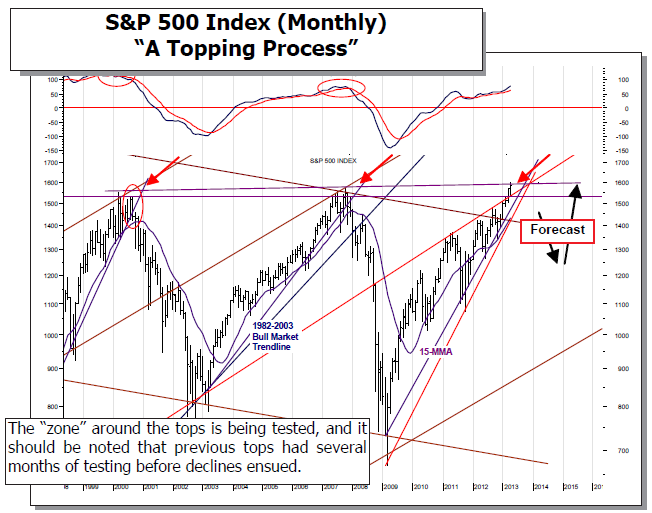

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1303; and the standard 200-dma support level at 1458. And with prices having difficulty into major long-term overhead resistance, we’ve begun to see a quiet exit out of stocks beneath the surface.

WORLD MARKETS ARE ALL HIGHER in the wake of the Italian parliamentary “deal” to seek a confidence vote for newly nominated Enrico Letta, which means Italy will have finally sit a government to deal with the its current economic problems. Of course Italy and Spain are trading higher, and their bond yields are trading lower, but so too is Germany trading higher…albeit at only a modest 0.3%. We should note at this point that all the major European bourses are off their highs, and one gets the sense this development was “discounted” to a large degree by the recent sharp decline in Italian bond yields. Furthermore, we’ll believe that the Italian parliament will a very difficult road ahead when it attempts to move forward on the economy…especially with Mr. Berlusconi of the center-right. The Euro currency is rallying on the news, and the commodity markets are modestly higher with the exception of the precious metals, which are trading more than modestly higher. Finally, in the lead chart on page 2 we illustrate the weekly Italian FTSE MIB Index chart; and we’ll note that once the 15,377 level is violated, then the honeymoon will be clearly over for Italian stocks, and likely bonds as well.

To Read the Entire Report Please Click on the pdf File Below.