STOCKS:

The fundamental backdrop is likely to be volatile: the Italian election is not yet resolved in terms of a sitting government; US “sequestration” is in place; and China is moving to “dampen” their housing market. These issues, coupled with the Cypriot depositor saga. will dominate the headlines in the short-term, but longer-term — the Eurozone recession, the likely decline in corporate margins/ profitability and the Fed’s potential tapering of QE will serve as strong headwinds.

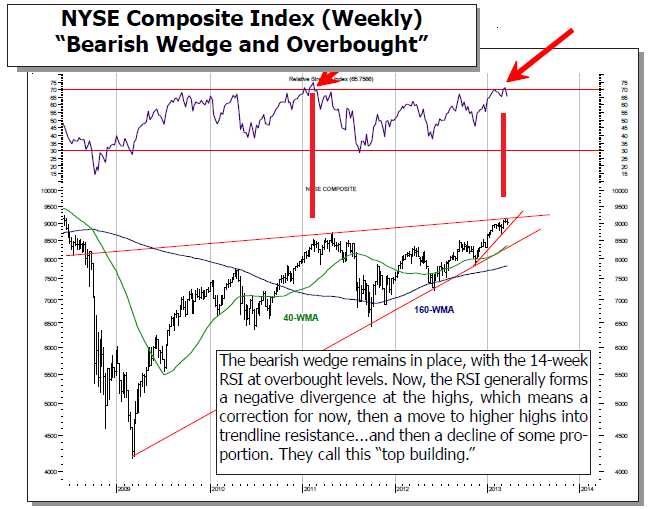

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1287; and the standard 200-dma support level at 1424. Collectively, with the breakout above the September 2012 highs at 1475 has run into major long-term overhead resistance, and should find “rough sledding” in the weeks ahead as a top is formed. This, coupled with our models in increasingly negative lights puts the risk-reward to the downside.

WORLD MARKETS ARE RATHER “FLATTISH” ON THIS FRIDAY as the only market that has declined in a substantial manner is Japan…down -2.35%. Europe, where all the fun is these days it would appear – is flat after having opened lower. Optimism regarding the Cypriot situation is driving the trade, for today there was a release out of Germany that business investment sentiment or the IFO index fell relative to expectations and to the prior month – and for the first time in 5-months. Outside of this and Cyprus…there is absolutely nothing that the markets are focusing upon. In the US today, there are no economic reports, hence the Cyprus tail will wag the US dog so to speak.

To Read the Entire Report Please Click on the pdf File Below.