STOCKS:

The world economy is weakening: the US payroll tax increase and “sequestration” are pressuring the US economy; China is being pressured by Japan, and both the US and China housing market has been “dampened”. The Eurozone remains mired in “inaction.” We feel that risk is being mispriced at current levels given recent weak world economic figures and developing pressure upon corporate revenues/margins/earnings. At some point, the market will view the central banks will be nonsequitur.

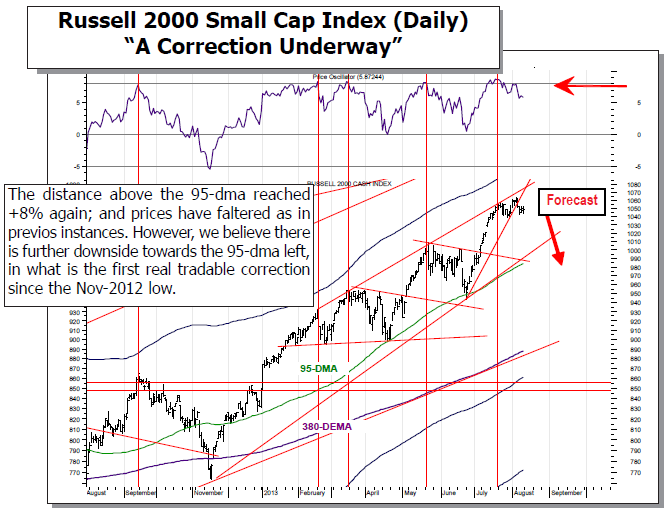

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1353; and the standard 200-dma support level at 1543. But perhaps more importantly, the distance above the 160-wma remains mired at the +23- to +25%% “bubble-like rally” threshold. We believe a correction of some proportion is forthcoming — on the order of -10% to -15%.

WORLD MARKETS ARE ON BALANCE “LOWER” as the summer doldrums are clearly on exhibit this Monday morning. The Asian bourses are “mixed”, with Japan’s NIKKEI dropping very modestly as Japan’s GDP rose by only +2.6%...far below the +3.6% level expected. This calls into the policy question as whether to raise sales taxes or not. The Japanese authorities have been clear on their need to do so in order to raise revenue to pay down the “quadrillion” yen debt they have amassed. But this figure calls into question whether this is a good idea or not, for implementing it regardless may push Japan backwards in terms of the recent economic gains seen. This is the first “quandary” faced by Japanese authorities in a number of months; and it is a critical one to the market to be sure.

To Read the Entire Report Please Click on the pdf File Below.