STOCKS: The world economy is healing. However, there remains clear headwinds to the continuation of this healing, such as the emerging market risk-reassessment and China weakening. Quite clearly, we believe risk is being mispriced at current levels given the cross-roads of QE ending and prices relative to the economic backdrop, not to mention clear pressure upon corporate revenues/margins/earnings.

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1458, but perhaps more importantly, the distance above the 160-wma stands at+27% — down from a high of +28%. If it expands above +30%, then an upside explosion is under way.

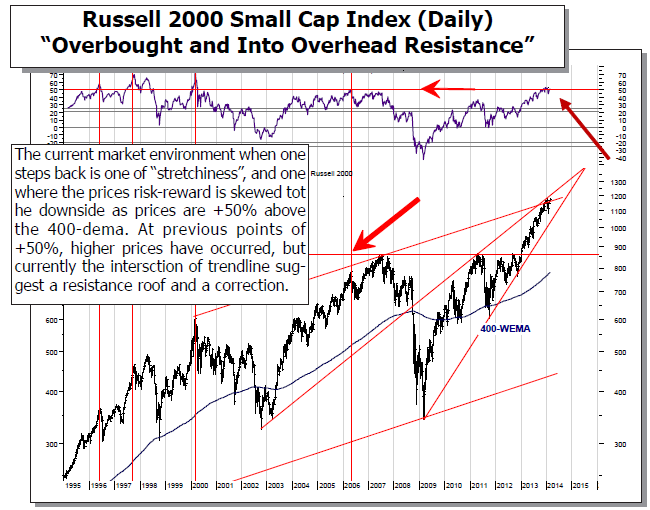

WORLD MARKETS ARE ONCE AGAIN MOSTLY LOWER after yesterday’s sharp early US rally that felt if it was simply one of the quicker short-covering rallies we’ve seen in quite some time. However, this strength faded after lunch, with prices cutting their gains “in half” by day’s end. Today, only Japan’s NIKKEI has followed the US gains higher, with European bourses faltering today on the over -2.0% losses in China. If there is a black swan developing for the US and world markets, it appears to China. We should further note that yesterday’s US rally did nothing to the percentage of stocks above their 200-day moving average where it remains at 75%...far below its highs, which simply means it is in divergence. This isn’t normal behavior for a market that wants to extend higher, but one in the process of distributing to weaker hands and in lieu of a larger correction. At the end of that correction, then we’ll look for higher prices…but the riskreward until then is simply not worthy of being broadly long (note the Russell is +50% above long-term support…a warning sign) except for several exceptional situations.

To Read the Entire Report Please Click on the pdf File Below