STOCKS

: The fundamental backdrop is volatile: the Italian election is not yet resolved in terms of a sitting government; US “sequestration” is in place; and China continues to “dampen” their housing market. These issues, coupled with the “troika” bail-in decision placed upon Cyrpiot depositors, increase the risk-premiums on stocks. Too, lest we not forget that the ISM and Chicago manufacturing surveys surprised to the downside in March — which puts pressure upon corporate margins/ earnings.

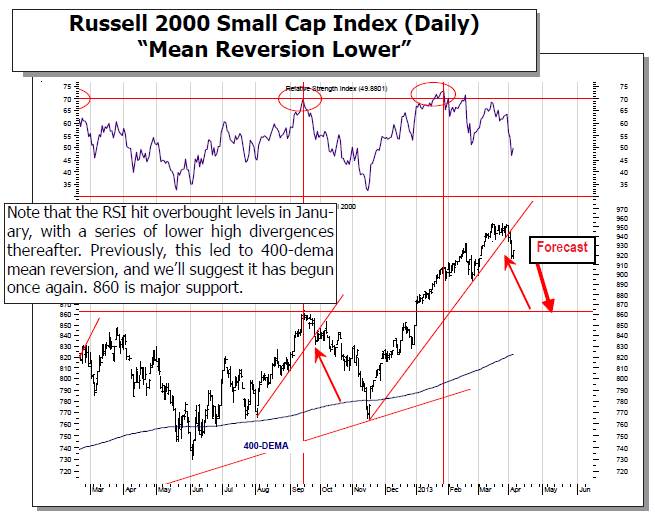

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1295; and the standard 200-dma support level at 1436. Now, with prices into major long-term overhead resistance, they are finding “rough sledding” as prices aren’t able to make much headway. Hence, the risk-reward is towards lower prices, which is confirmed by a number of our short-term models.

WORLD MARKETS ARE LOWER…WITH THE EXCEPTION OF JAPAN: And once again, the dichotomy between Japan and the rest of the world continues after the Bank of Japan (BOJ) stated it was prepared to expand the Japanese monetary base by 100% in the next 2-years. This has pushed the yen sharply lower; it has pushed the NIKKEI higher…sharply so. This is a rather dangerous game for Japan, and the risk of a full blown currency crisis grows by the day as the yen falls against the USD and all the other currencies. Certainly, China and South Korea must be seething at this point as Japan has embarked upon targeting its currency. Now, the Japanese authorities won’t tell you that, for it is simply not what they promised the G-20. But their policies speak to doing so – regardless if it is disguised as defeating inflation; or that the yen falling is collateral damage. We find it rather interesting that Fed Vice Chairman Yellen supported the Japanese move last night in a speech. Remember, she is likely to be the new Fed Chairman in January 2014 if Bernanke is not asked, or decides not to return.

To Read the Entire Report Please Click on the pdf File Below.