“FORECAST”

STOCKS: The fundadmental backdrop is volatile: the Italian election is not yet resolved in terms of a sitting government. US “sequestration” is in place, and China continues to “dampen” its housing market. These issues, coupled with the “troika” bail-in decision placed upon Cyrpiot depositors, increase the risk-premiums on stocks. The ISM and Chicago manufacturing surveys surprised to the downside in March, which puts pressure upon corporate margins and earnings.

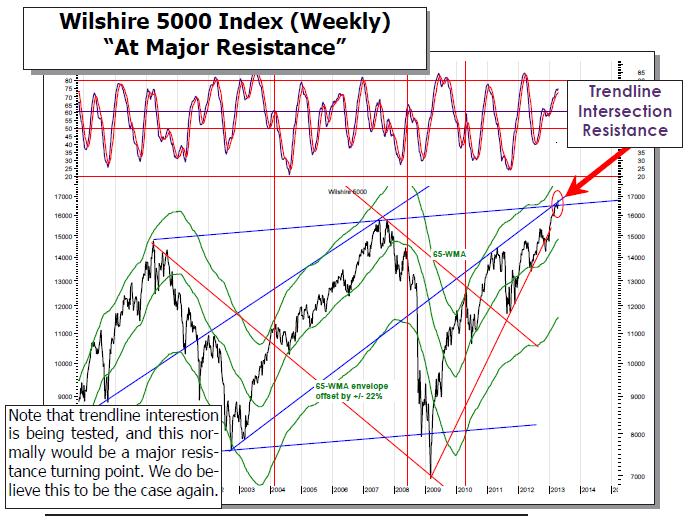

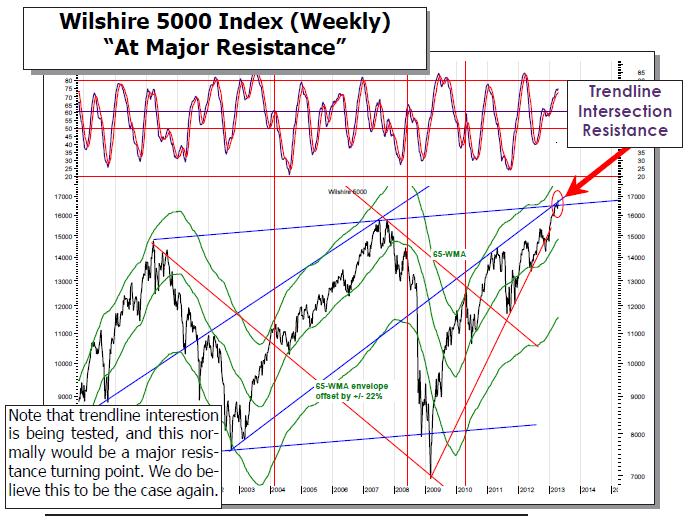

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1295, and the standard 200-dma support level at 1446. Now, with prices into major long-term overhead resistance, they are finding “rough sledding” as prices aren’t able to make much headway. The risk-reward is towards lower prices, as confirmed by a number of our short-term models.

ALL MAJOR MARKETS ARE LOWER Asian bourses were not able to add onto the gains seen in parts of the U.S. market during Thursday’s trade. Japan’s markets are extended like a very tight rubber band, and China’s can’t seem to get any traction because of the Japanese yen sharp depreciation. In Europe, all the markets are lower by roughly -1.3%, on reports that Cyprus has asked for more aid. These reports were quickly and vociferously denied, with the Cypriot President stating that the only aid they are seeking is technical and structural.

To Read the Entire Report Please Click on the pdf File Below.

STOCKS: The fundadmental backdrop is volatile: the Italian election is not yet resolved in terms of a sitting government. US “sequestration” is in place, and China continues to “dampen” its housing market. These issues, coupled with the “troika” bail-in decision placed upon Cyrpiot depositors, increase the risk-premiums on stocks. The ISM and Chicago manufacturing surveys surprised to the downside in March, which puts pressure upon corporate margins and earnings.

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1295, and the standard 200-dma support level at 1446. Now, with prices into major long-term overhead resistance, they are finding “rough sledding” as prices aren’t able to make much headway. The risk-reward is towards lower prices, as confirmed by a number of our short-term models.

ALL MAJOR MARKETS ARE LOWER Asian bourses were not able to add onto the gains seen in parts of the U.S. market during Thursday’s trade. Japan’s markets are extended like a very tight rubber band, and China’s can’t seem to get any traction because of the Japanese yen sharp depreciation. In Europe, all the markets are lower by roughly -1.3%, on reports that Cyprus has asked for more aid. These reports were quickly and vociferously denied, with the Cypriot President stating that the only aid they are seeking is technical and structural.

To Read the Entire Report Please Click on the pdf File Below.