Investing.com’s stocks of the week

FORECAST

STOCKS

The European debt contagion has been “kicked down the road” as Spanish and Italian short-and-long term bond yields have moderated recently given the ECB “plan” to buy bonds of up to three-years in maturity...but only if asked; and only if conditionality is imposed upon those asking. The Fed has also changed its game from “inflation-fighting” to “unemployment fighting”; and with any war -- they will go further and farther than anyone believes in printing money to achieve their ends. This will support all asset prices ultimately.

STRATEGY

The S&P 500 remains above the 160-wma long-term support level at 1233. The much followed 200-dma support level stands at 1365, and remains the bulls “Maginot Line.” We’ve noted this is perhaps one of the “weirdest rallies” we’ve ever been witness to, and it causes us a great deal of consternation. But the new Fed policydirectly targets stocks; expect a near S&P all-time high test at 1515-to-1530.

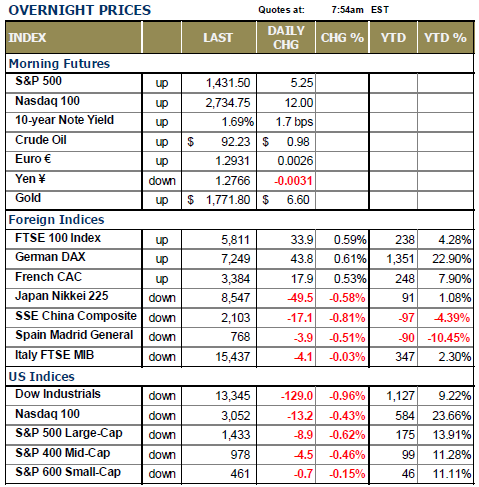

ASIAN BOURSES ARE LOWER; BUT EUROPEAN BOURSES HAVE TURNED HIGHER as S&P downgraded Spain to one-notch above junk; and issued a “negative” outlook. Moody’s had already taken Spain to this level previously. But as the thought goes, this pushes Spain closer to the edge of oblivion and renews pressure upon Spain to quit dragging their feet and formally request an aid package, which the market wants. Prime Minister Ranjoy has said he will only make an aid request decision when he has all the details; but the fact of the matter is Mr. Ranjoy is waiting for his home region elections in Galicia on October 21st before making a decision. He has no other decision; Spain will require a bailout; we will welcome it once it comes to fruition. Lastly, let’s note the Spanish 10-year notes are higher by 8 bps to 5.89%...far lower than the 7.62% that was in place during July.

This move by S&P has caused “hope” that a request will come sooner rather than later, which has pushed the European bourse modestly higher, and the S&P futures higher by +8 points. We should note even through yesterday’s weakness, the S&P futures are a higher level this morning than they were yesterday when we marked prices prior to releasing our report. Moreover, “risk-on” seems to be “on” for the moment, with the Euro currency rising and the USD falling; precious metal prices are higher; energy is higher and copper is higher. These are the necessary ingredients for a rally; but whether it extends remains to be seen. Certainly we can make the case prices are oversold on a short-term basis, and are rising in tandem with our model turning higher form oversold levels on an hourly basis.

TRADING STRATEGY

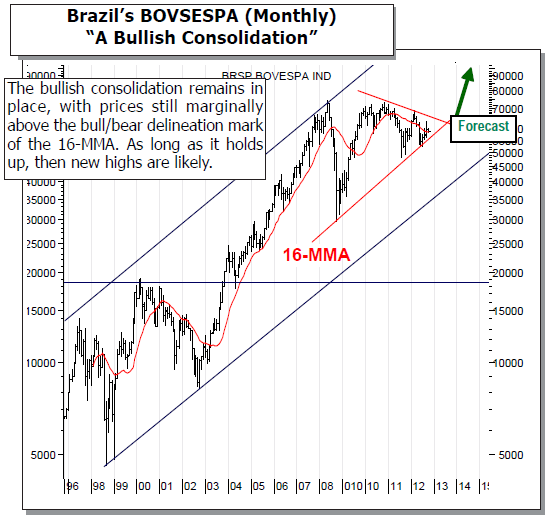

We are long China and Brazil; Natural Gas and Copper via FCX; long bond yields via TBT, and long Microsoft and Weatherford Int’l. This is rather aggressive for us, but certainly over the past two trading sessions as the down lost nearly -2%, our model portfolio lost less than one-half of this, and therefore its relative performance has been rather nice. Now, we need to see a rally upon which “spread its wings” and provide the gains we expect to see.

We are not looking to add any other positions at this point, although certainly FedEx (FDX) rallied sharply yesterday above its major moving averages and remains in a bullish consolidation pattern. If we are to add, then we would be patient and allow yesterday’s gain to digest and then consider adding FDX…and possibly exiting any

underperforming position that is yet to be determined. Nothing more at this point.

To Read the Entire Report Please Click on the pdf File Below.

STOCKS

The European debt contagion has been “kicked down the road” as Spanish and Italian short-and-long term bond yields have moderated recently given the ECB “plan” to buy bonds of up to three-years in maturity...but only if asked; and only if conditionality is imposed upon those asking. The Fed has also changed its game from “inflation-fighting” to “unemployment fighting”; and with any war -- they will go further and farther than anyone believes in printing money to achieve their ends. This will support all asset prices ultimately.

STRATEGY

The S&P 500 remains above the 160-wma long-term support level at 1233. The much followed 200-dma support level stands at 1365, and remains the bulls “Maginot Line.” We’ve noted this is perhaps one of the “weirdest rallies” we’ve ever been witness to, and it causes us a great deal of consternation. But the new Fed policydirectly targets stocks; expect a near S&P all-time high test at 1515-to-1530.

ASIAN BOURSES ARE LOWER; BUT EUROPEAN BOURSES HAVE TURNED HIGHER as S&P downgraded Spain to one-notch above junk; and issued a “negative” outlook. Moody’s had already taken Spain to this level previously. But as the thought goes, this pushes Spain closer to the edge of oblivion and renews pressure upon Spain to quit dragging their feet and formally request an aid package, which the market wants. Prime Minister Ranjoy has said he will only make an aid request decision when he has all the details; but the fact of the matter is Mr. Ranjoy is waiting for his home region elections in Galicia on October 21st before making a decision. He has no other decision; Spain will require a bailout; we will welcome it once it comes to fruition. Lastly, let’s note the Spanish 10-year notes are higher by 8 bps to 5.89%...far lower than the 7.62% that was in place during July.

This move by S&P has caused “hope” that a request will come sooner rather than later, which has pushed the European bourse modestly higher, and the S&P futures higher by +8 points. We should note even through yesterday’s weakness, the S&P futures are a higher level this morning than they were yesterday when we marked prices prior to releasing our report. Moreover, “risk-on” seems to be “on” for the moment, with the Euro currency rising and the USD falling; precious metal prices are higher; energy is higher and copper is higher. These are the necessary ingredients for a rally; but whether it extends remains to be seen. Certainly we can make the case prices are oversold on a short-term basis, and are rising in tandem with our model turning higher form oversold levels on an hourly basis.

TRADING STRATEGY

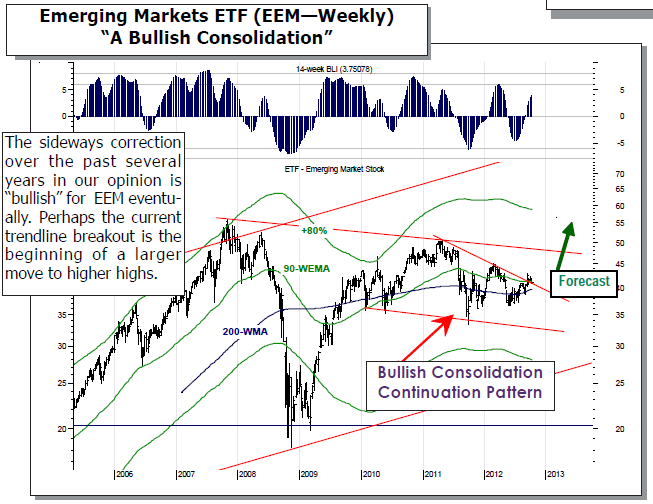

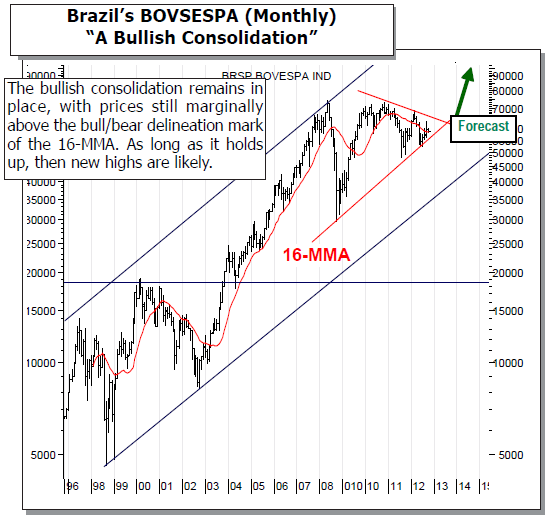

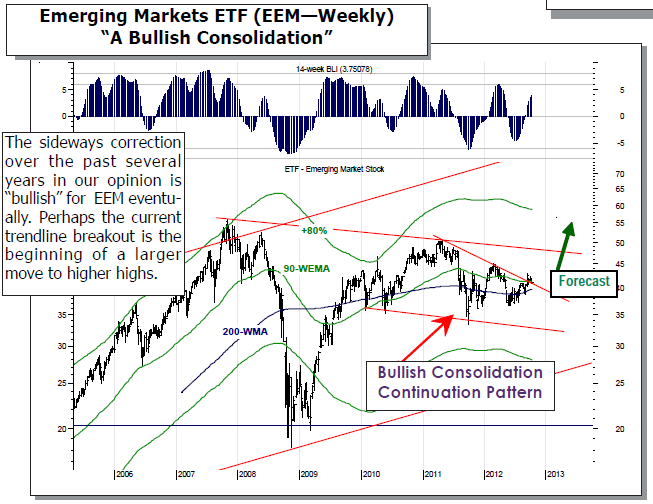

We are long China and Brazil; Natural Gas and Copper via FCX; long bond yields via TBT, and long Microsoft and Weatherford Int’l. This is rather aggressive for us, but certainly over the past two trading sessions as the down lost nearly -2%, our model portfolio lost less than one-half of this, and therefore its relative performance has been rather nice. Now, we need to see a rally upon which “spread its wings” and provide the gains we expect to see.

We are not looking to add any other positions at this point, although certainly FedEx (FDX) rallied sharply yesterday above its major moving averages and remains in a bullish consolidation pattern. If we are to add, then we would be patient and allow yesterday’s gain to digest and then consider adding FDX…and possibly exiting any

underperforming position that is yet to be determined. Nothing more at this point.

To Read the Entire Report Please Click on the pdf File Below.