STOCKS:

The European debt contagion remains front and center. Spanish and Italian short-and-long term bond yields have moderated recently given the ECB looks to step in to buy’em. This shall support stocks in the short-term, but won’t solve the overriding debt and fiscal problems...kicking the can down the road so to speak. So enjoy it while it lasts; after the euphoria will come the days of reckoning. How long? Good question.

STRATEGY: The S&P 500 remains above long-term support at the 160- wma at 1215; which delineates bull/bear markets. However, the 200-dma support level at 1334 remains the bulls “Maginot Line”, while overhead resistance at 1340-to-1360 was extended above and now becomes support. This, coupled with the recent S&P 500 bullish weekly key reversal higher has suggested the 1450-to-1500 zone would be tested; but gosh darn it...this rally is one of the “weirdest” we’ve seen, and this obviously causes us some degree of trepidation. Melt-up or melt-down?

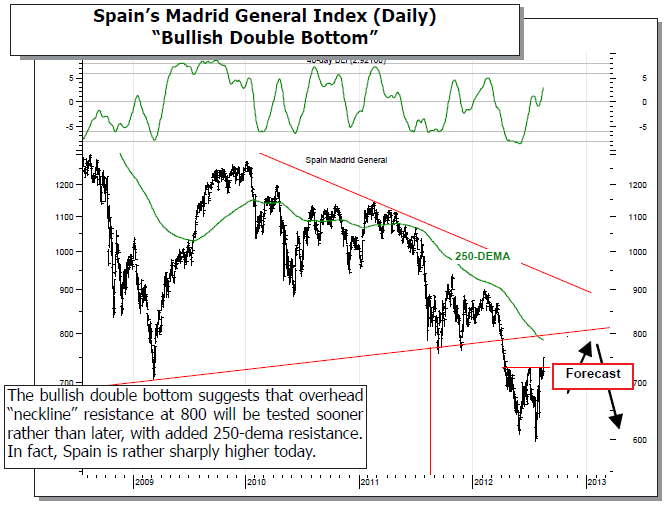

FRIDAY BEGINS WITH GREEN ACROSS THE BOARD as European bourses are once again in the news. There are rumors that Spain is running out of cash, and will formally ask for bailout funds in the days ahead, while Germany’s Merkel during a trip to Canada stated that her country is “committed to do everything we can in order to maintain the common currency” – thereby echoing the words of ECB President Draghi. This has been sufficient for a rather “stout” rally in Spain’s Madrid General Index of almost +1.6% this morning on top of yesterday’s move higher of +4%. Today, we’ve included a chart of Spain’s Madrid Index – and indeed there appears to be modest room for further improvement to the 800 level. But that is where the moment of truth is, for it represents both shortterm and long-term resistance.

On that note, we should point out that Italy’s FTSE MIB Index is higher by +1.8% this morning, which now puts the index “in the black” for the year. We find this rather optimistic given the country is in recession as 2Q GDP fell by - 0.7%; and that there is no relief in sight, which means Italy will be mired in recession for some great while.

TRADING STRATEGY: We are long, although we pared back our long broad market exposure on Wednesday given the “weirdness” of this rally. However, hind-sight is 20-20, and risk management is paramount during rallies such as this. As for the S&P 500 – we’ve narrowed our upside range to 1435-to-1460, which is apex resistance stands on the monthly charts. We continue to view energy positively; as well-

as the precious metal stocks…and indeed we’ll add a long position in Goldcorp (GG) today given its technical breakout.

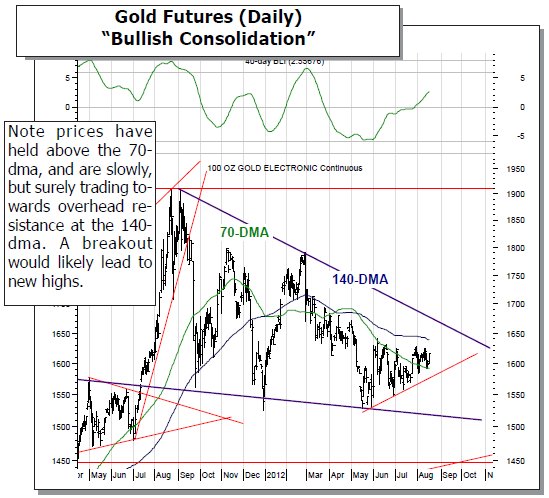

We’ve look to be long the precious metal stocks with a gold breakout above $1645, which is where the 140-day moving average crossed (now at $1638). But, the precious metal stocks are behaving in much better fashion than gold itself. Thus, we are rather impressed, and we need more exposure – it’s just that simple. That said, this brings our Basic Materials weighting to 30% (NEM, GG and X), which

means if we need want to add silver to the portfolio…then we’ll need to divest of other stocks. We’ll assess the relative merits with the benefit of time.

To Read the Entire Report Please Click on the pdf File Below.