STOCKS:

The European debt contagion remains front and center. Spanish and Italian short-and-long term bond yields have moderated recently given the ECB looks to step in to buy’em. This shall support stocks in the short-term, but won’t solve the overriding debt and fiscal problems...kicking the can down the road so to speak. So enjoy it while it lasts; after the euphoria will come the days of reckoning. How long? Good question.

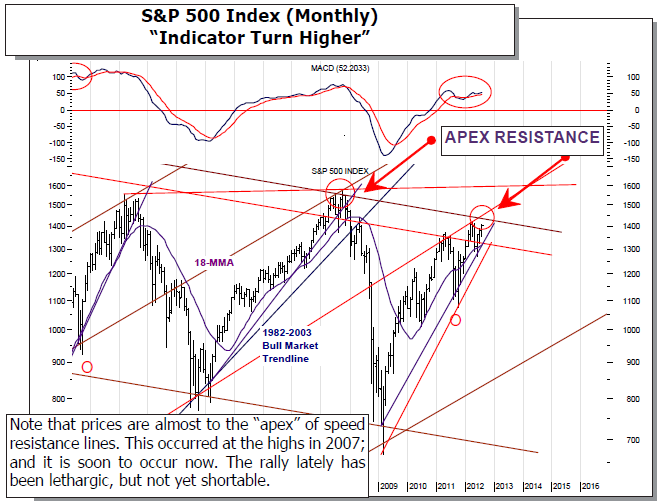

STRATEGY: The S&P 500 remains above long-term support at the 160- wma at 1215; which delineates bull/bear markets. However, the 200-dma support level at 1334 remains the bulls “Maginot Line”, while overhead resistance at 1340-to-1360 was extended above and now becomes support. This, coupled with the recent S&P 500 bullish weekly key reversal higher has suggested the 1450-to-1500 zone would be tested; but gosh darn it...this rally is one of the “weirdest” we’ve seen, and this obviously causes us some degree of trepidation. Melt-up or melt-down?

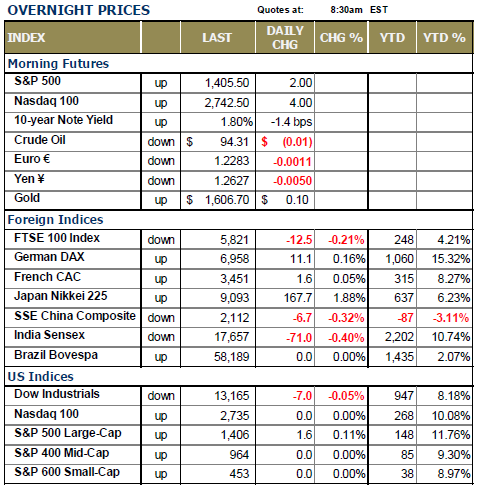

WORLD MARKETS ARE MIXED ACROSS THE BOARD as there is very little rhymes or reasons to trading this morning. Asian bourses were mixed, with China’s Commerce Ministry stating that the 2H-2012 trade looks to be rather dour given the Eurozone recession; and it further noted falling foreign investment growth. This pushed the Shanghai Composite lower modestly. In Europe, we are in the holiday period as well as the “quiet” period ahead of the important September meetings. Shuttle diplomacy is picking up, as European leaders don’t want a rehash of its past debacle with Greece.

Certainly to this point a good deal of good news has been discounted. One only needs understand that the German DAX and French CAC are higher on the year by +15% and 8% respectively. This is rather surprising to be sure, with the Eurozone in a recession and the currency in the process of crumbling. We’ll wonder aloud whether September marks the end of the rally of “hope”, and lower prices materialize. There is nothing to hang one’s short hat on yet; but certainly the manner in which the US market have traded this August has many technicians warning of a “suckers rally.”

TRADING STRATEGY: We are long, with us having pared back our long exposure quite by roughly 20% given the “weirdness” of this rally. Obviously, given UWM’s rally yesterday, we wished we hadn’t been so early, but risk management is paramount during rallies such as this. As for the S&P 500 – we’ve been on record as stating 1450-to-1500 is our target; but we’ll pull back on that just a bit and narrow it to 1435-

to-1460 as this is where monthly apex resistance stands on the monthly charts (lead chart page 1). We continue to view energy positively; as well as the precious metal stocks…we are looking to add to the position on a move in gold above the $1645 level, with the silver ETF (AGQ) being our vehicle of choice.

To Read the Entire Report Please Click on the pdf File Below.