Investing.com’s stocks of the week

This July could prove to be a testing month for FX markets, given the rise in trade tensions

There’s more value in outlining potential scenarios

This is a particularly uncertain time for FX markets; where the escalation in the global trade war ends nobody knows. This makes a baseline FX scenario exceptionally difficult.

Rather than delivering back-to-back cuts in our baseline EUR/USD profile (despite mounting pressure in that direction) this month we believe there’s more value in outlining potential scenarios. Our full scenario analysis can be found here.

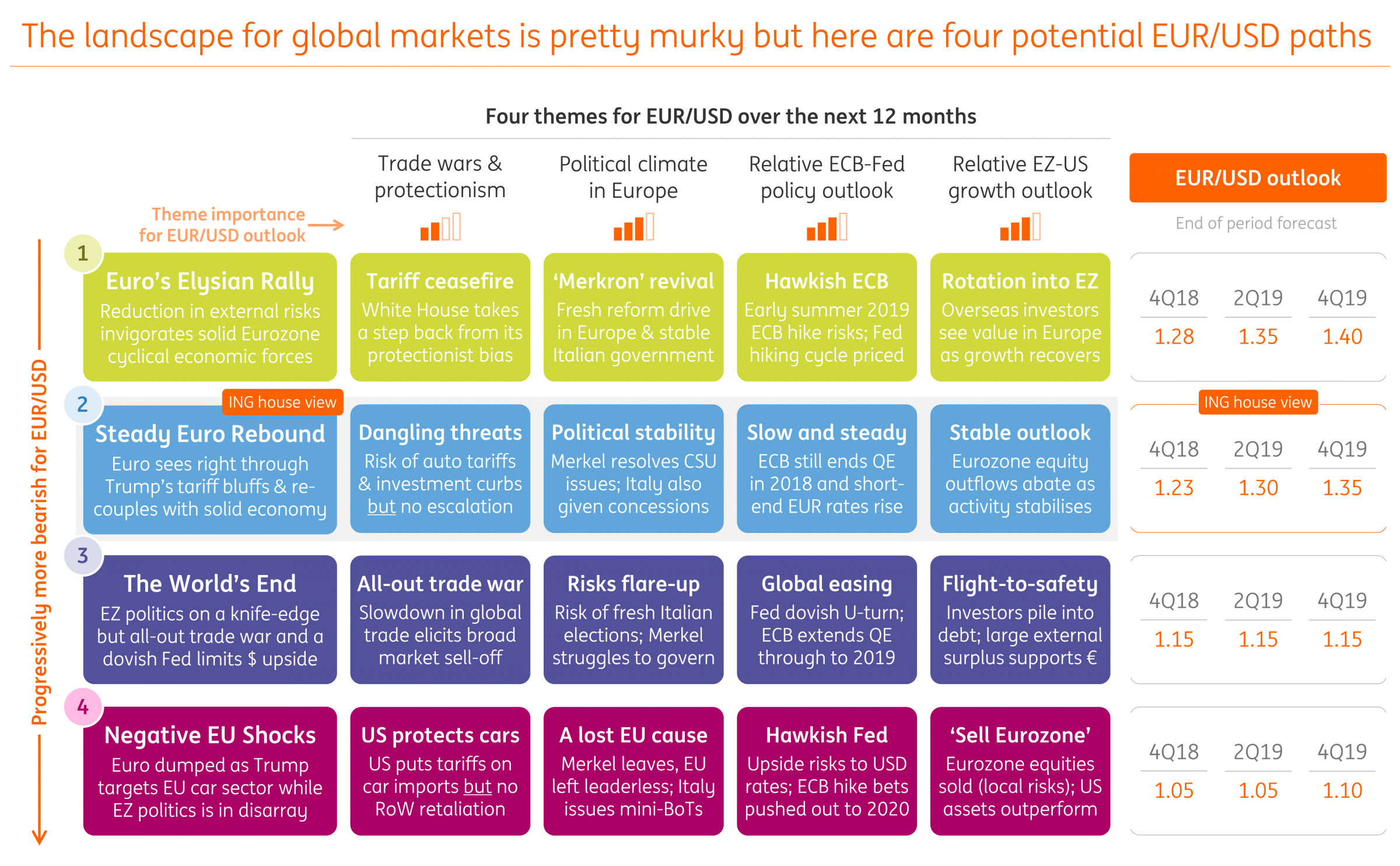

Below we summarise four potential paths for EUR/USD into 2019, all supported by various assumptions for some of the key inputs, such as rate spreads and risk premia.

Four scenarios for EUR/USD into end 2019

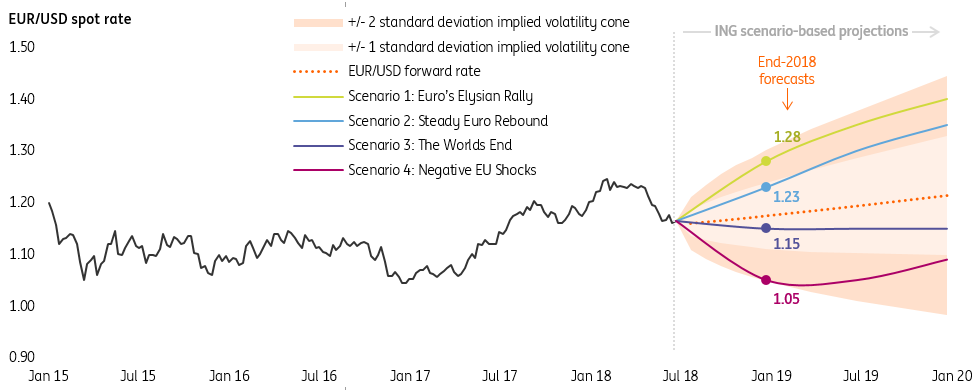

EUR/USD could potentially see 1.10 this summer

Compared to a tentative baseline of EUR/USD recovering to 1.23 by the end of the year, risks look clearly skewed to the downside. Were the Trump team to accelerate their review of auto imports and formally adopt the 20% tariffs on EU auto imports, we could potentially see 1.10 this summer. A scenario of 1.05 would, however, require: a) peak rate divergence where the US economy/Fed pricing is immune to rising trade tensions and b) peak pessimism on German and Italian politics.

It also remains a challenging time for EM FX. Slowing world trade and the Fed potentially taking policy into ‘tight’ territory could see the headwinds to EM turn into a hurricane.

EUR/USD spot rate projections

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. For our full disclaimer please click here.