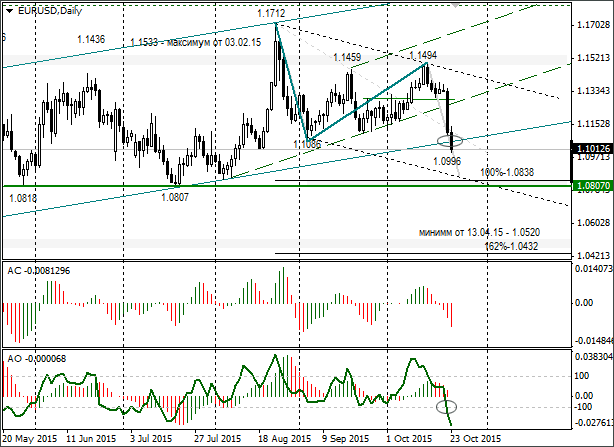

Trading opportunities for currency pair: after a break in the trend line, a fall for the euro to 1.0807 – 1.0838 is expected. It’s better to wait for a rebound to 1.1050/1.1060 on Monday. The idea will no longer be valid if the day closes above 1.1140.

Background

The last idea I did on the EUR/USD came out on 19th October. The price at the moment of publication was around 1.1348. In the idea, I looked at a weakening of the euro to 1.1250, then 1.1086 (by the middle of November) and 1.0290 in the medium term. The first two targets were reached following the ECB meeting. Mario Draghi had the biggest effect on the euro. Due to this I have made a new review with a 1.0807-1.0838 interim price zone.

Current situation

The price at the moment this idea was published was 1.1012. We have a break in the trend line as part of a correctional movement from 13th March, 2015’s minimum (1.0461). Trader attention is now focussed on the incoming FOMC meeting which will take place on 27-28 October. Draghi frightened market participants by stating the possibility of a deposit rate decrease and an extension of QE in December. Here we need to take into account the fact that the next ECB meeting will take place on 4th December with an FOMC meeting due to follow it on 15-16 December. The ECB in this case has to take its decision before the FOMC, without knowledge of what the Fed will do. The ECB could surprise us on 4th December, so don’t get caught out. The Swiss National Bank (SNB) is keeping its finger on the pulse since it doesn’t like it when the Swiss franc becomes too strong against the euro.

What’s interesting at the moment?

The EUR/USD has broken through the trend line with its correctional movement. The break renewed the fall of the euro along the trend which takes its beginnings from a 1.3992 maximum from May 2014. The EUR/USD often corrects against Friday’s movements on a Monday. As such, it’s better not to sell euros today. I’m leaning towards saying the hourly is forming another minimum (double bull divergence) with the last recoil to 1.1090. Overall, it’d be better for it to stay below 1.1050. However this is more likely to take place on Tuesday than Monday. The FOMC meeting which will take place from 27-28 October and before we see the outcome of the meeting, there will be unpredictable movements of the price.

Now about the new targets. Nothing difficult. I’ve copied the length of the wave from 1.1712 to 1.1086 and I’ve put a clone of it at the 1.1494 maximum. By using this line I get a target price of 1.0838. This is where the lower limit of the channel is set up at three points: 1.1712, 1.1494 and 1.1086. The next support zone is at 1.0807-1.0818 (27th May and 20th July minimums). As soon as this zone has been passed, the road to 1.0520 (13th April, 2015 minimum) will open up.