This week the markets will primarily be focused on the FOMC meeting and the potential Taper. Overall market is pricing in various amount of Taper and we still suspect we will see some tapering, however the two major risks to this events are no Taper at all being USD Negative and a much larger Taper being USD positive.

Meeting is on Wednesday with the statement released at 7pm GMT.

Prior to the meeting though we have Draghi up Monday morning and we have the UK MPC minutes earlier on the Wednesday.

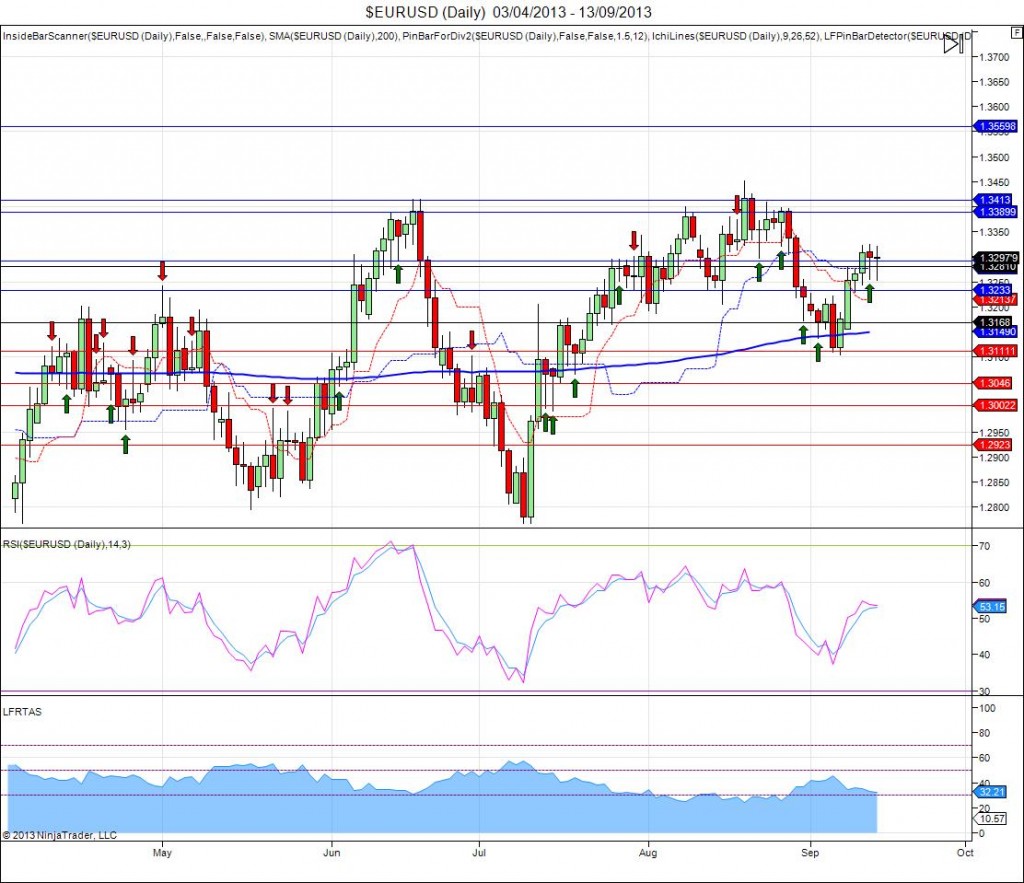

EUR/USD

Long: 1.3260

RTAS Order Book systems still holding longs this pair as we continue to see some Retail Sellers, however this has really stalled although we did see some Retail Selling towards the close on Friday. Support comes in at the 1.3230 level, resistance comes in around the 1.3325 mark. EUR/USD" width="1024" height="919">

EUR/USD" width="1024" height="919">

The pair continues to chop at current levels. Pair now looks like it could be ready to reverse and find a few more Retail Buyers but seems to be waiting for a good catalyst with the FOMC meeting next week the obvious choice. EUR/USD 2" width="1024" height="883">

EUR/USD 2" width="1024" height="883">

Interesting movements in the COT report this week as Non Commercials have really reduced their net Long positions, if this gathers momentum this week we could easily see a switch in bias towards the downside. We suspect a lot could rest on the FOMC meeting. EUR/USD 3" width="1024" height="799">

EUR/USD 3" width="1024" height="799">

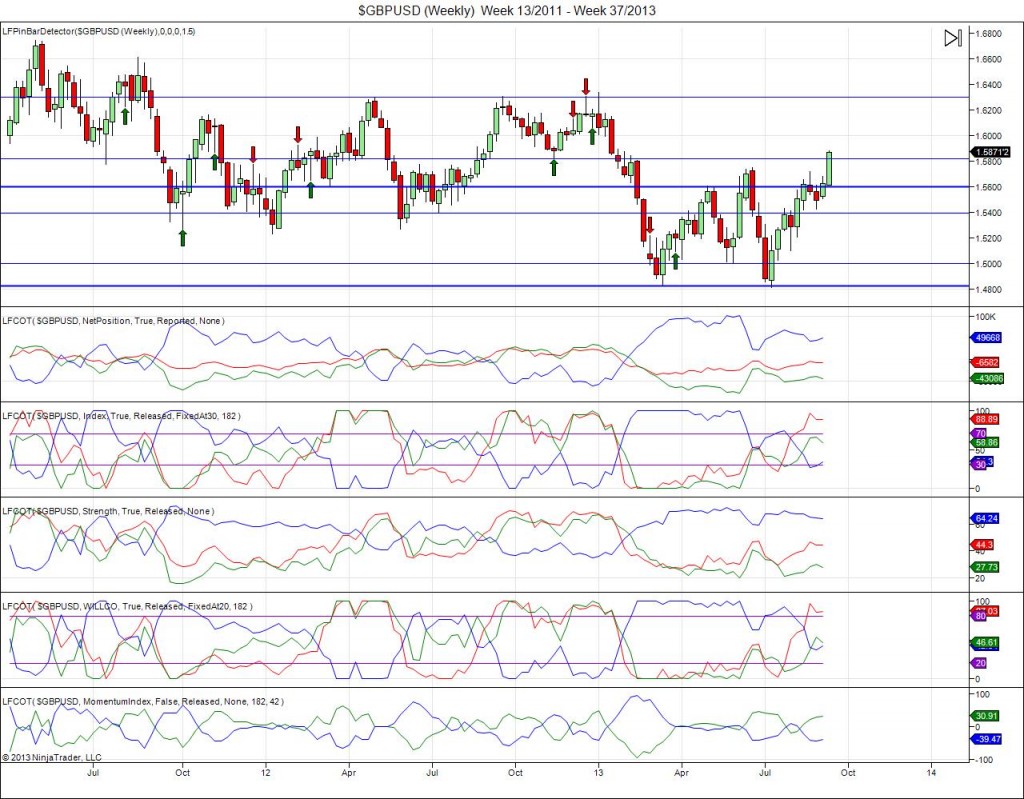

GBP/USD

Long: 1.5620

RTAS Order Book systems holding longs in this pair as it continued to push higher again on Friday. Now below the magic 30% figure in Retail Traders long this pair, which inevitably means that any move higher now will need to clear out orders if it is to proceed. Having now broken the 1.5775 level convincingly this turns to a key support level, that said the pair is close to reversals at this level so MPC minutes and Taper will be key. GBP/USD 1" width="1024" height="919">

GBP/USD 1" width="1024" height="919">

If we stay above the 1.5775 support level the next major resistance comes in around the 1.6000 level. We still maintain that fundamentally this pair is overbought and we would expect it to make a correction lower. GBP/USD 2" width="1024" height="883">

GBP/USD 2" width="1024" height="883">

COT report saw Non Commercials adding towards shorts last week as Momentum slowed. The weekly chart could be moving towards highs back at the 1.6300 level, however Non Commercial Positioning does point towards a move lower at least back towards support at 1.5600 level. GBP/USD 3" width="1024" height="799">

GBP/USD 3" width="1024" height="799">

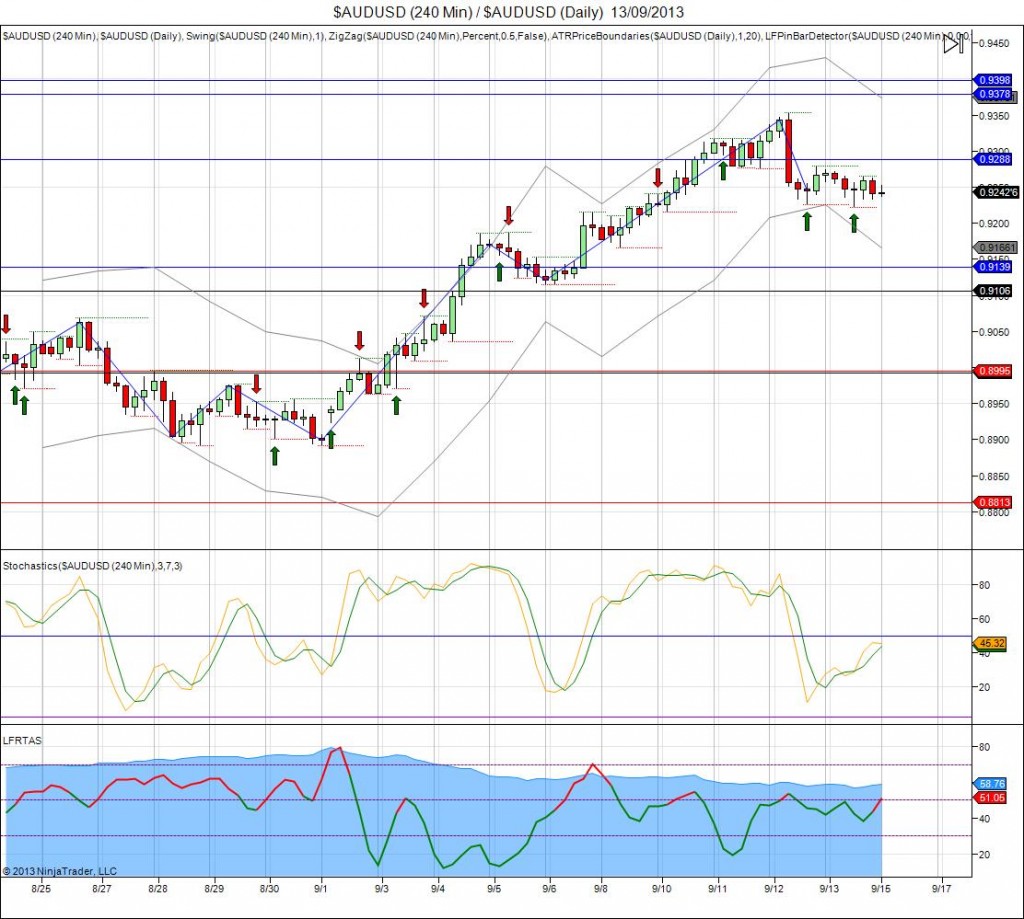

AUD/USD

Short: 0.9240

Systems switched from longs to shorts as the pair consolidated on Friday. Some minor Retail Buying then saw Retail Order Books switch towards shorts again. If we continue to see some further buying in the pair we could see the pair push lower back to support again. Support comes in at the 0.9220 followed by the 0.9140 level with resistance at the 0.9290 / 0.9380 level. AUD/CAD 1" width="1024" height="919">

AUD/CAD 1" width="1024" height="919">

Key to watch resistance and supports levels in this pair now as it has started to break away from its lows as it carves out its bottom. If the pair can manage to stay above the 0.9200 level we could see it correct further towards 0.9400 then potentially towards 0.9700. Fails at resistance is likely to find Retail Buyers on dips and could cause a further push lower. A lot could depend on how much the RBA want to push this pair lower or wider more general US Dollar strength. AUD/CAD 2" width="1024" height="883">

AUD/CAD 2" width="1024" height="883">

COT Momentum pointing back towards shorts for Non COmmercials as the slight retracement in Non Commercial buyers ended last week. The Weekly pin bar could also point to a move lower with the pair rejecting the resistance towards the 0.9400 level. AUD/CAD 3" width="1024" height="799">

AUD/CAD 3" width="1024" height="799">

EUR/AUD

Short: 1.4690

The RTAS Order Book system still holding shorts in this pair, despite the slight pop higher on the Aussie data. Retail Traders now selling the pair again means we could see the pop higher continue slightly although overall we prefer this pair for another move lower. Support comes in at the 1.4250 / 1.4180 levels with key resistance at the 1.4470 mark. EUR/AUD 1" width="1024" height="919">

EUR/AUD 1" width="1024" height="919">

Pair had formed a nice double top formation with an extremely large RSI divergence. The key support levels offered a nice area for this pair to bounce from oversold RSI levels. If we break the 1.4135 support level we could easily see this pair then move back below the 1.4000 handle, the 1.4470 level now acts as key resistance. EUR/AUD 2" width="1024" height="883">

EUR/AUD 2" width="1024" height="883">

EUR/GBP

Long: 0.8400

Order Book systems have chopped around at current levels when the pair broke out of lower levels. Towards the close the pair put in a nice support pin bar off of the 0.8375 level. Retail Traders now seem essentially flat in the Order Books as they wait for the next major move. The pair has seemed relatively supported at the 0.8375 / 0.8350 level but resistance comes in just above at the 0.8430 / 0.8445 level, potentially a nice one for breakout plays. EUR/GBP 1" width="1024" height="883">

EUR/GBP 1" width="1024" height="883">

The pair pushed lower again on Friday breaking support. It continues to look heavy but is likely due a correction from the oversold area. The Order Book is now close to extremes again which could offer a turning point, although we would prefer to see Order Books slightly higher before a push higher again. EUR/GBP 2" width="1024" height="883">

EUR/GBP 2" width="1024" height="883">

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI