Brent crude prices continued to drop yesterday, reaching a four-year low. It appears that several oil producers in the Middle East want to keep production levels high, even if it means a drop in the price per barrel. Numerous commentaries are currently circulating as to Saudi Arabia’s interest in getting the world used to prices under $90.

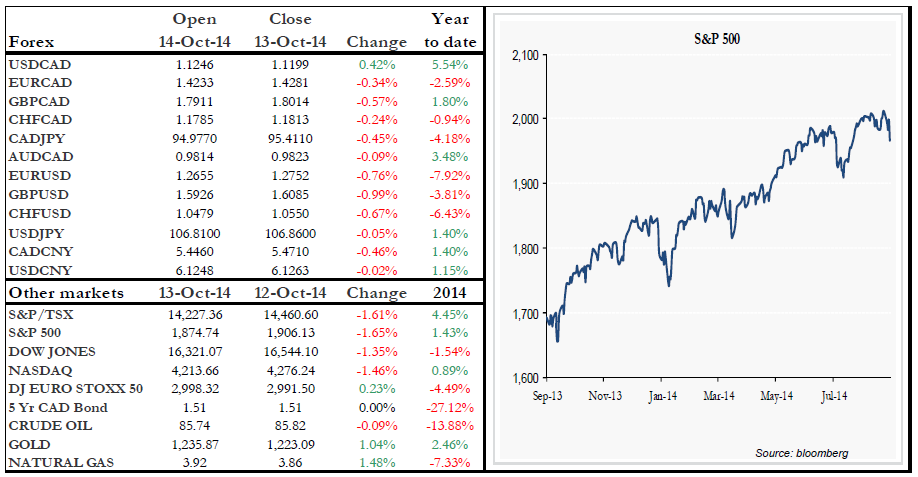

Concerns related to global economic health continue to weigh heavily on U.S. stock exchanges, which once again closed in the red yesterday (S&P 500 -1.49%, Dow Jones -1.19%, NASDAQ - 1.33%). It also bears mentioning that the S&P 500 closed below its 200-day moving average. This level of turbulence on markets can notably be seen in the CBOE Volatility Index (VIX), which is at its highest level in the past 28 months.

No major news is expected in North America this morning and U.S. futures are currently in neutral territory.

Range of the day: 1.1195 – 1.1280

Range of the next 5 days: 1.1050 – 1.1350