Yesterday’s Ivey Purchasing Managers Index for Canada surprised analysts, with the strongest monthly variance in close to five years, rising from 50.9 to 58.6. This positive reading helped the loonie gain close to 1% for the first day of the week.

In a statement overnight, the Bank of Japan declared that the country’s economy continues to rebound moderately. As anticipated, the BoJ will maintain its stimulus measures consisting of 60 to 70 trillion yen in asset buybacks per year. The Reserve Bank of Australia also announced overnight that it was keeping its key rate unchanged at 2.5%

This morning’s German Industrial Production figures showed a contraction of 4% in the past month. This indication of a slowing European economy appears to be leading American stock exchanges toward an opening in the red.

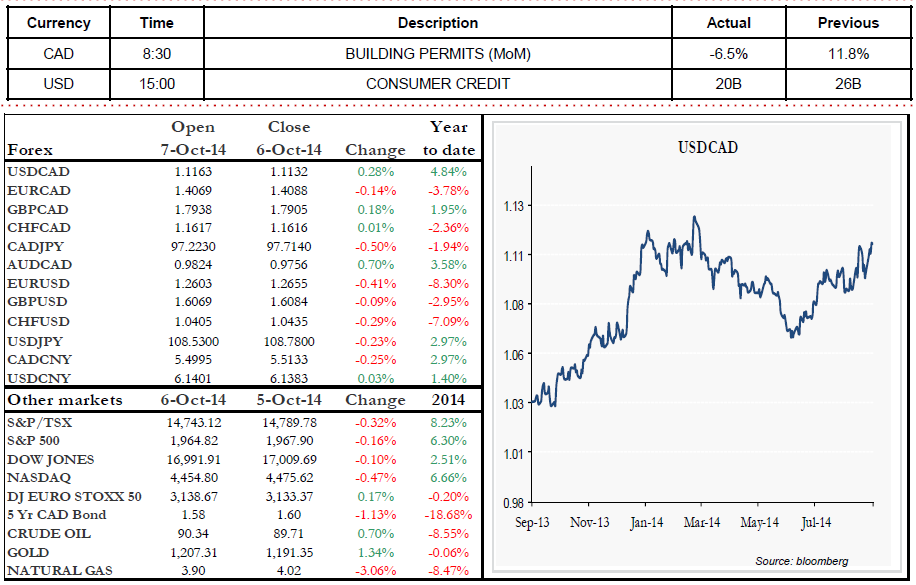

Today, we will be keeping an eye on Canadian Building Permits and U.S. Consumer Credit.

Range of the day: 1.1120 – 1.1220

Range of the next 5 days: 1.1050 – 1.1350