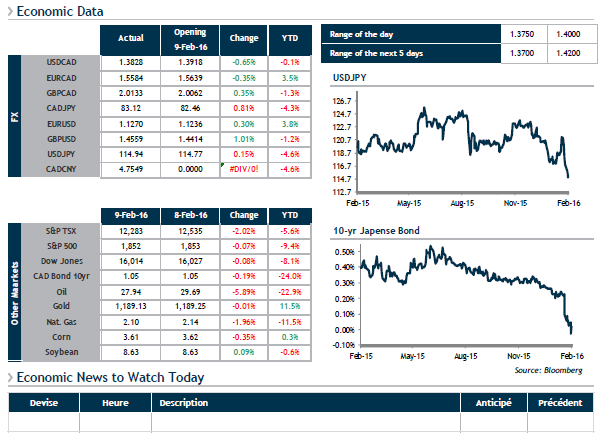

Financial markets were shaken up once again on Tuesday by fears surrounding the capitalization of European banks and plunging crude oil prices. Nervous investors seeking security are continuing to buy government bonds and selling riskier assets such as equities and corporate bonds. The sharp spike in the Japanese yen, the go-to safe haven currency, is an illustration of this fact. While stocks on the Nikkei have dropped 5.4%, demand for Japanese government bonds is so great that Japan is the first economy to see yields on its 10-year bonds fall below zero.

Today marks the first speech in eight weeks by Fed Chair Janet Yellen, at 10:00 AM, when investors will sift carefully through her remarks for clues as to where interest rates are headed south of the border. With an increasingly jittery market, the outlook for a key rate increase in March is now basically nil. It’s difficult to predict what path the loonie will take in this volatile context, but with stock markets and crude oil stabilizing this morning, we are likely to see it rise today.