Stock markets in the red again

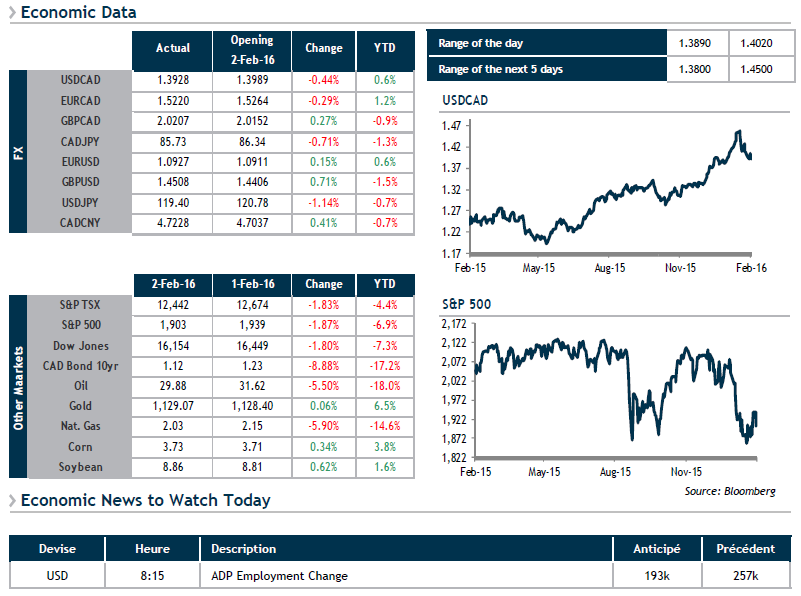

Yesterday was another tough one on international stock markets. After one of the worst starts to a year ever, the situation seems to barely be improving, with stocks in New York and Toronto down 1.75% and 2.54% respectively since the start of February. Uncertainty regarding China, the Federal Reserve and commodities appears to be cancelling out the decent earnings reported by listed companies.

All these doubts and fears are creating a very volatility-friendly environment that helps drive up socalled “safe haven” currencies such as the U.S. dollar, euro, yen and pound sterling. As such, USD buyers could take advantage of short-term downturns in the USD/CAD pair to hedge a portion of their needs.

Lastly, after several attempts, U.S. hardware giant Lowe’s has purchased Quebec-based chain Rona for $3.2 billion Canadian, which represents a premium of more than 100% compared to yesterday’s closing price! Who knows, maybe the loonie’s weakness against the greenback helped out with the negotiations.