Fed opts for caution

The decision to leave the key rate unchanged was accompanied by a cautious statement containing three important points: -consideration of deteriorating global economic conditions and their potential impacts on the U.S. economy -consideration of the economic slowdown and persistently weak inflation, particularly wages

-consideration of the strength of the job market

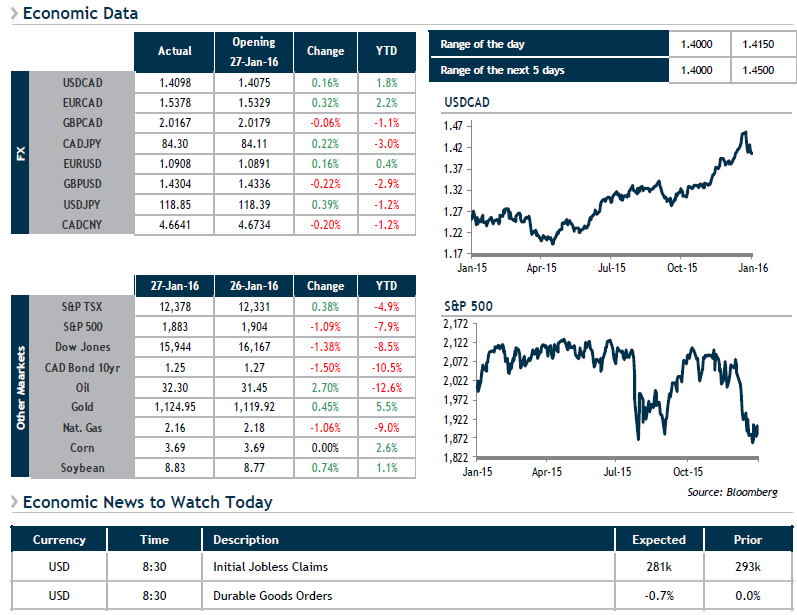

The likelihood of a new rate hike in March is low (25%) and the positive reaction for the USD to the news may be shortlived. However, the tone of the comments may not have been pessimistic enough to get us to 1.3800 in the short term. It’s important to keep in mind that what is moving currencies the most at present is commodity prices in general, and crude oil in particular.

We’ll be keeping our eye on a number of economic indicators today south of the border, including Weekly Jobless Claims and Durable Goods Orders. Tomorrow, Canadian GDP will bear watching closely.