In the Fed’s shoes

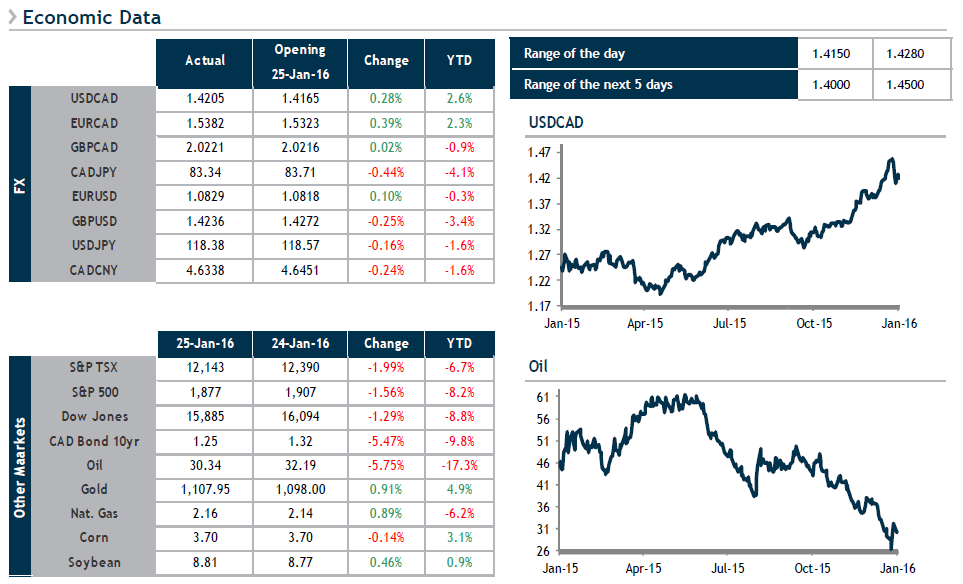

Let’s look beyond the relatively boring day yesterday that saw crude oil drop 7%, slightly weakening the CAD. Instead, let’s look ahead to the Federal Reserve meeting tomorrow at 2 p.m. No key rate movement is expected after the increase in December. If you were at the helm of the world’s most powerful central bank, what would the tone of your comments be regarding:

-GDP showing signs of slowing?

-Jobless claims at their highest level since mid-2015?

-A disastrous January for major stock indexes (S&P 500: -8 %)?

-Your rising currency (USD), which could have a negative impact on your exporters? It is possible that your tone may be a little less upbeat than in December, which could rein in the soaring greenback.

What’s more, on our side of the border, the Bank of Canada has now clearly told the government to do its job (spending, fiscal stimulus measures), which should bode well for the CAD. That’s the risk scenario this week for USD sellers. Should it come to pass, the 1.3800-1.4000 range could be appealing to buyers.