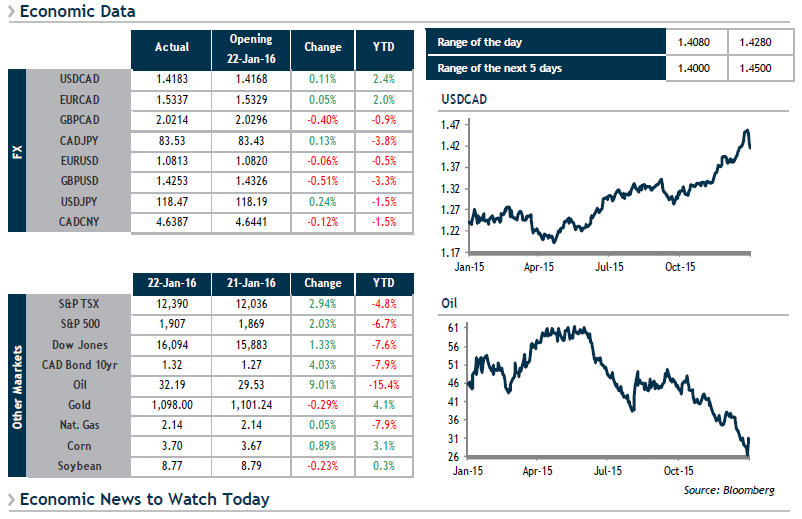

Since the Bank of Canada’s key rate decision last Wednesday, the USD/CAD pair has shifted gears into correction mode, helped greatly by a technical rebound in crude oil (+9% Friday) and global equities. The question that all importers (USD buyers) are certainly asking themselves now is twofold: Is this a simple correction, and where will it stop? Nothing for the moment indicates a changing trend and we will be keeping our eyes on the 1.3800-1.4000 range, which should serve as a support level in the coming weeks.

In any case, the volatility seen since the start of the year should be reason for caution; importers who were looking at 1.4600-1.4700 a few days ago should take advantage of current rates and place orders between 1.4000 and 1.3800.

For exporters (USD sellers), the situation remains relatively upbeat, with rates above 1.4000. The greatest risk would be a less optimistic tone from the Federal Reserve, which will be forced to comment on the tense international climate when it announces its key rate decision on Wednesday at 2 p.m. The market could then scale back the number of key rate increases anticipated for the year.