Busy week about to kick off

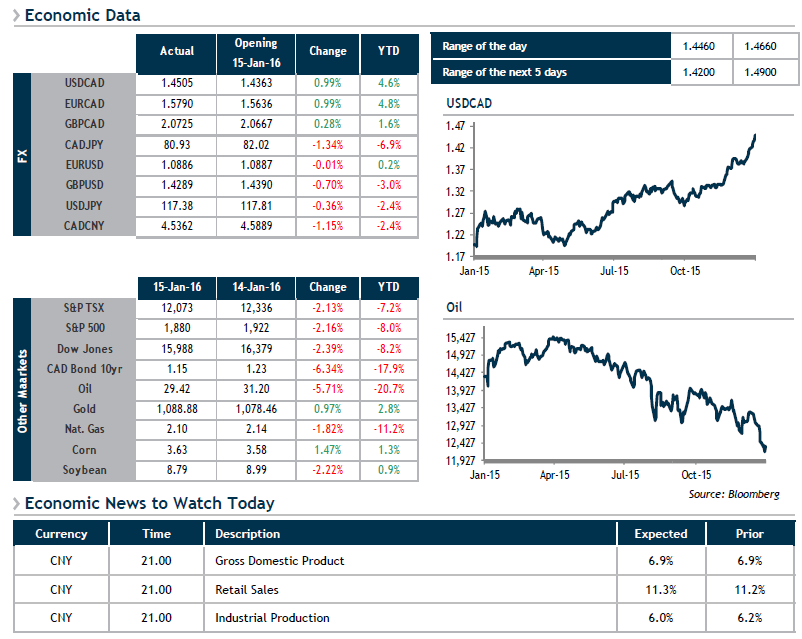

While our neighbours south of the border are enjoying a day off in honour of Martin Luther King, we’re diving into a week jam-packed with economic indicators and decisions. First off, a wealth of data on the Chinese economy will be published this evening at 9 p.m. We’ll be keeping an eye on Industrial Production, Retail Sales and Q4 2015 GDP, which is expected to be stable at 6.9%. It’s highly likely that the outcome of these readings will set the tone for the rest of the week.

Next off, in the middle of the week, we’ll get a look at U.S. inflation and the Bank of Canada’s key rate decision. Many observers expect the BoC to react to the drop in crude oil prices by trimming its key rate a quarter point to 0.25%. Markets are currently pricing the likelihood of such a move at 64%. This could be very bad news for the Canadian dollar, which is already trading at its lowest level since June 2003!

Lastly, on Thursday, all eyes will turn to the European Central Bank, as it decides whether to also add to its expansionary policies to support the EU’s economy.