Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

CAD beaten down again

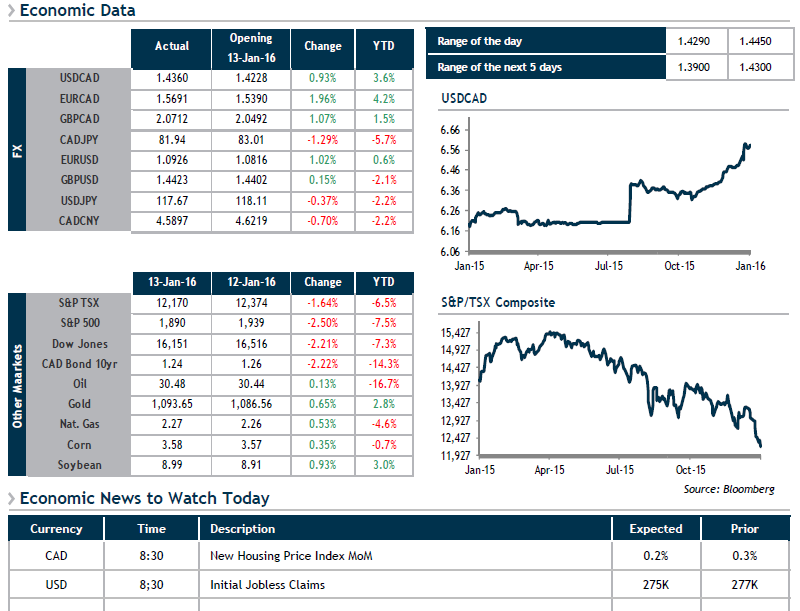

The announcement that U.S. crude oil inventories were up proved the catalyst for still more weakening for the CAD, which closed yesterday below the 70-cent mark. What’s more, a growing number of pundits now think that it is likely that the Bank of Canada could cut its key rate at the January 20 meeting. It’s difficult to determine the probability of such a move at this stage, since as recently as last week, BoC Governor Stephen Poloz appeared satisfied with the current situation and favoured other tools over a rate cut.

The danger with this scenario is obviously the letdown that could result if the BoC were to opt to hold firm. The loonie could then quickly regain some of its lost altitude once market anticipations were readjusted. If Governor Poloz does opt to cut the bellwether rate, an additional decline in the CAD would be the most likely outcome. Without wanting to sound alarmist, it is important for everyone to act in accordance with their risk tolerance.

In the meantime, we’re still waiting on the Trudeau government’s economic stimulus plan, with the Prime Minister simply stating yesterday that Canadian growth had lagged for the past 10 years and that he was making it his top priority.