Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Relatively good news from China

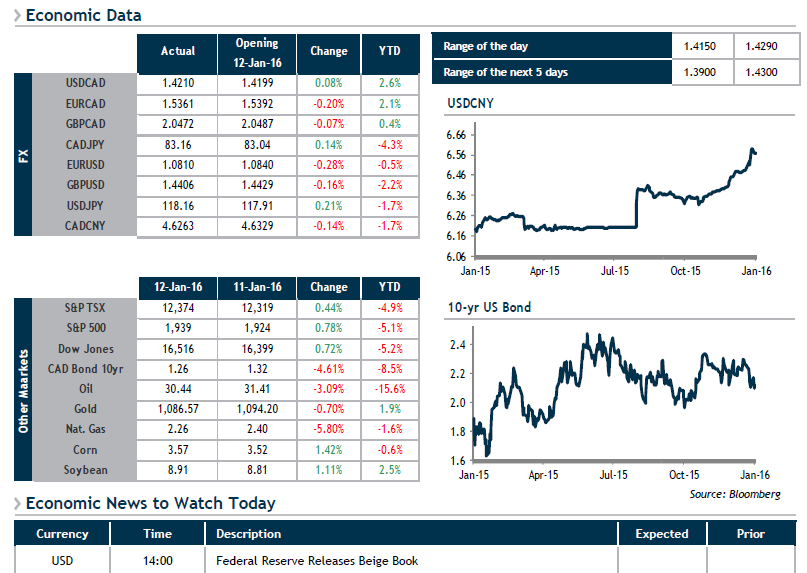

All asset classes were hard-hit again yesterday, as even the most upbeat pundits appear to be giving in to concerns. North American stock markets, crude oil and other commodities started the session in the green, only to see a large portion of their gains erased. In bonds, U.S. 5- and 10-year yields also fell, signalling a measure of doubt regarding the Fed’s timetable for monetary tightening.

The IEA added its grain of salt to the petroleum saga, cutting its forecast for crude oil in 2016 from $50.89 to $38.54 a barrel and calling for $47 in 2017. Even more importantly, the agency trimmed its U.S. production forecast for next year to 8.73 million barrels/day from 8.76 million, showing that it does not anticipate a significant dropoff in volumes.

On a more positive note, we also learned that Chinese exports only fell by -1.4% in December, much less than the projected -8%. Given the reliability of Chinese indicators, this trend remains to be confirmed, however. On the whole, China’s trade surplus reached 3.96 trillion yuan in 2015, down 8% vs. the previous year and the worst performance since the financial crisis.