New 11-year low for the loonie!

Bank of Canada Governor Stephen Poloz struck a rather optimistic tone yesterday in a speech given in Toronto. He said that the Canadian economy, at least for the time being, does not need the BoC to deploy the same unconventional monetary policies adopted by other central banks. The two rate cuts earlier this year were sufficient, in his opinion, to fend off the threat of a more severe recession in Canada, further to the collapse in commodity prices.

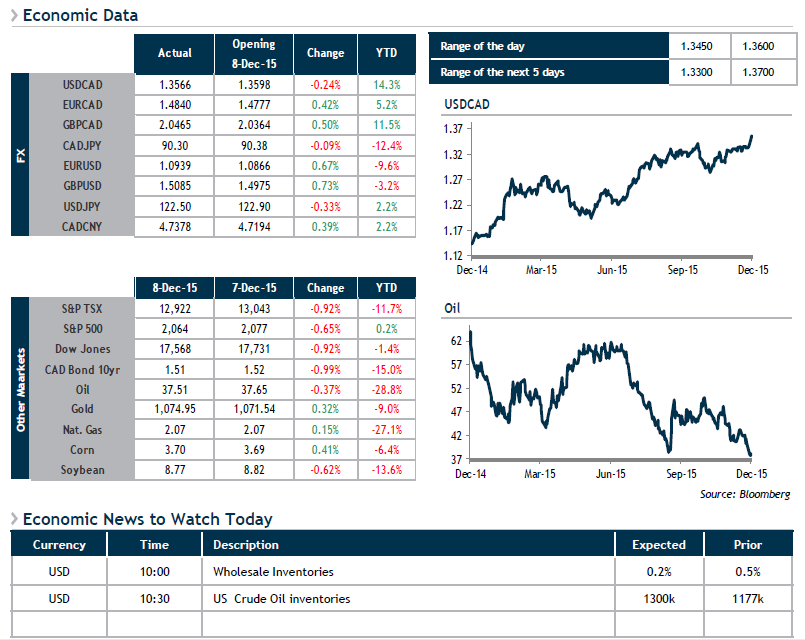

Despite a number of risk factors (slowdown in China, risk of deflation and excess petroleum production), Mr. Poloz remains confident that the country’s economy will be back to firing on all cylinders around mid-2017 with inflation close to the target of 2%. These comments failed to buoy up the loonie, which sank to an 11-year low, as it remains just as sensitive to crude oil prices. Today, we will be keeping an eye on Cushing Crude Oil Inventories when they are announced at 10:30.

Last night, we also learned that Chinese inflation grew by 1.5% in November, stimulated by rising food and service prices. The demand in the world’s second largest economy appears to be stabilizing further to the fiscal and monetary measures adopted by Chinese officials throughout the year.