Investing.com’s stocks of the week

Oil down sharply!

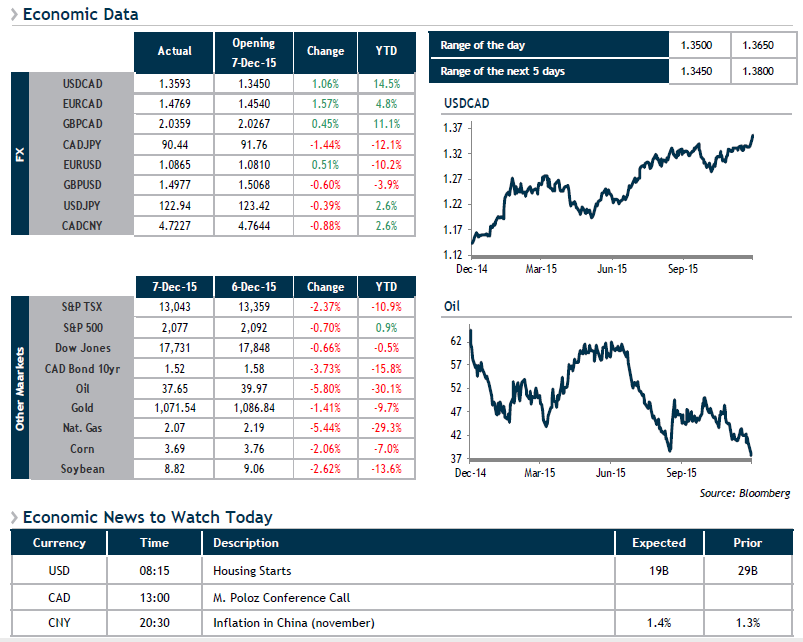

Friday’s announcement from OPEC that it would no longer enforce a quota resulted in a drop of close to 6% in crude oil, which ended the day at $37.65 a barrel and dragged down all commodity-based currencies in its wake (CAD -1%, AUD -1%, NZD -1.5%, NOK -1.7%). The persistent weakening in crude oil prices should ramp up the pressure on central banks as they fight to contain the risk of deflation. If central bankers decide to adopt more accommodative measures over the next year, the Fed will have more wiggle room to manage the pace of its rate hikes.

This morning, European markets and U.S. futures are down further to the release overnight of lower exports and higher-than-anticipated imports in China. This evening, Chinese inflation data will be posted (CPI, PPI). In Europe, annualized eurozoneGDP gained 1.6% as expected.

Today at 1 p.m., Bank of Canada Governor Stephen Polozwill discuss unconventional monetary policy at the Empire Club of Canada in Toronto.