Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

No inflation in Europe

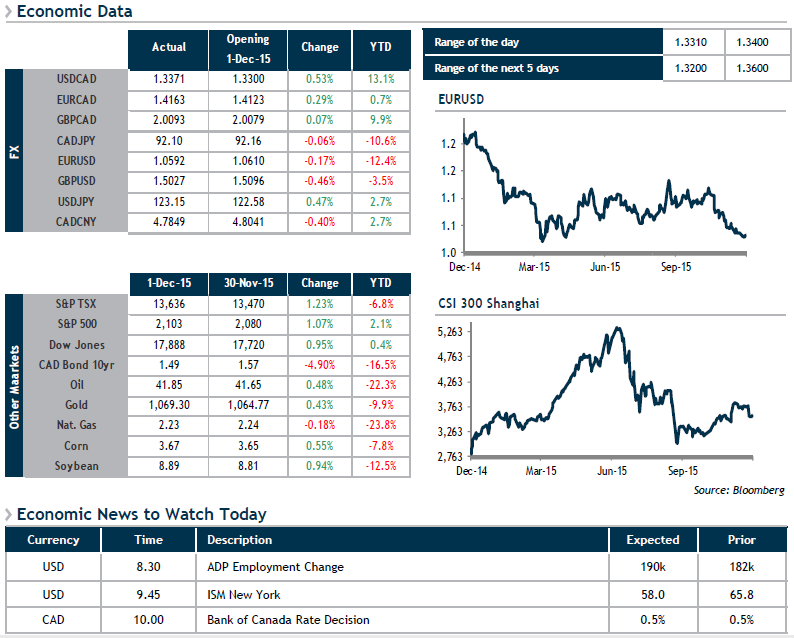

Not surprisingly, we learned a little earlier this morning that eurozone inflation for November was virtually non-existent, with prices growing only 0.1% on an annualized basis. Even if more volatile elements such as food and energy are removed, core inflation was only 0.9%. The European Central Bank therefore appears to have free rein to announce an increase to its current 65 billion euro quantitative easing program tomorrow. Obviously, the euro lost ground on the news and appears inclined to test historic lows.

Closer to home, we’ll have a key rate decision from the Bank of Canada at 10 a.m. today. Markets do not anticipate a change in course from the BoC, which should keep the rate unchanged at 0.5%. Yesterday, we learned that the Canadian economy grew 2.3% in the past quarter, however September saw a -0.5% decline. As such, it would appear that the recovery, much like the loonie, remains fragile.