The European Central Bank Could Intervene Even More

This morning there are new speculations afoot regarding a potential ramping up of the quantitative easing program in Europe, and they have driven European stock markets higher and the euro to its lowest level in more than 7 months against the greenback. European stock markets mirrored the upswing recorded by U.S. stock markets yesterday, which finally ended a bearish sequence of more than 7 days.

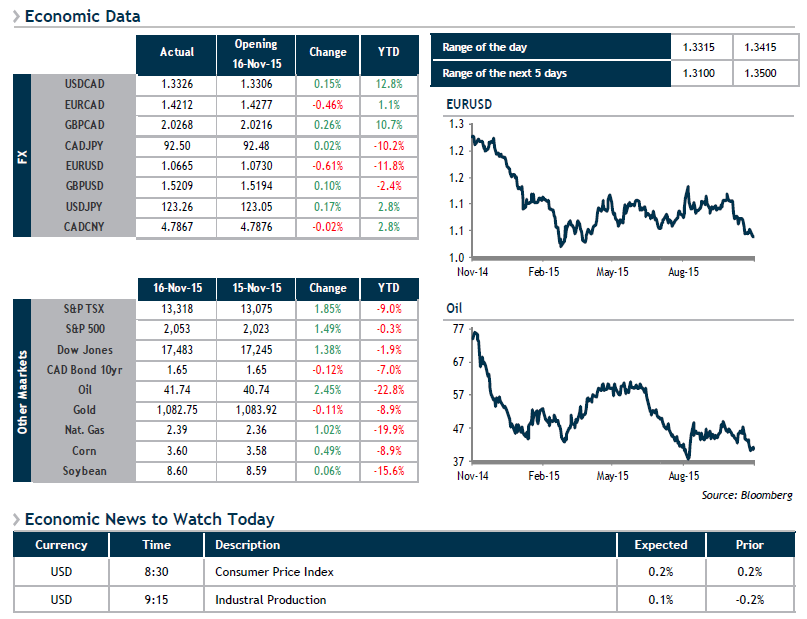

Since last Thursday, crude oil prices had flirted dangerously with the psychological level of $40/bbl, without going below it however. After having neared this level at the start of the session yesterday, crude oil prices rebounded to finally end the day higher by 2.45%. This in turn gave wings to the loonie, which yesterday was one of the only currencies that rose against the greenback.

Today we will be monitoring one specific economic indicator from the U.S., i.e. inflation figures for October. This reading will provide us with more clues regarding the next FOMC decision, slated for December 16.