Investing.com’s stocks of the week

Japan Slips Back Into Recession

Following the tragic events that took place in Paris on Friday, our thoughts are with the French people. This morning, Japanese GDP growth figures have revealed that the country has officially entered into a recession for the second time since 2012. Weaker investments are reported to be the major cause of the contraction in the economy, as the economic slowdown in China has caused Japanese companies to postpone their investment projects.

Still in Asia, the Managing Director of the IMF Christine Lagarde has officially supported including the Chinese yuan in the elite basket of SDR currencies. The yuan would join the U.S. dollar, the euro, the pound sterling and the yen. The official decision should be rendered towards the end of the month and is expected to only be a formality. Being included within this group represents an important step in internationalizing the Chinese economy. In the short term, few pundits are expecting a major impact on FX markets, as the Fed and economic growth figures are attracting more attention from investors.

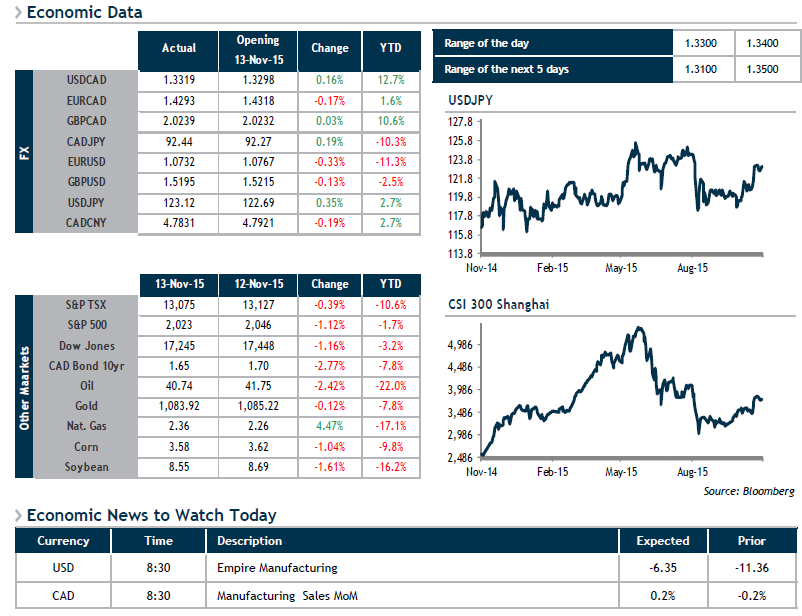

Today, few economic indicators are slated in Canada and the U.S. As such, we expect the loonie to mirror variations in crude oil prices.