In its key rate decision yesterday, the Fed confirmed that a rate increase remained a possibility in December. The deciding factor will be inflation, which Janet Yellen and the FOMC expect to increase as the job market firms up and salaries rise. However, the risk of deflation remains very much a possibility around the world, which will continue to exert downward pressure on prices in the United States.

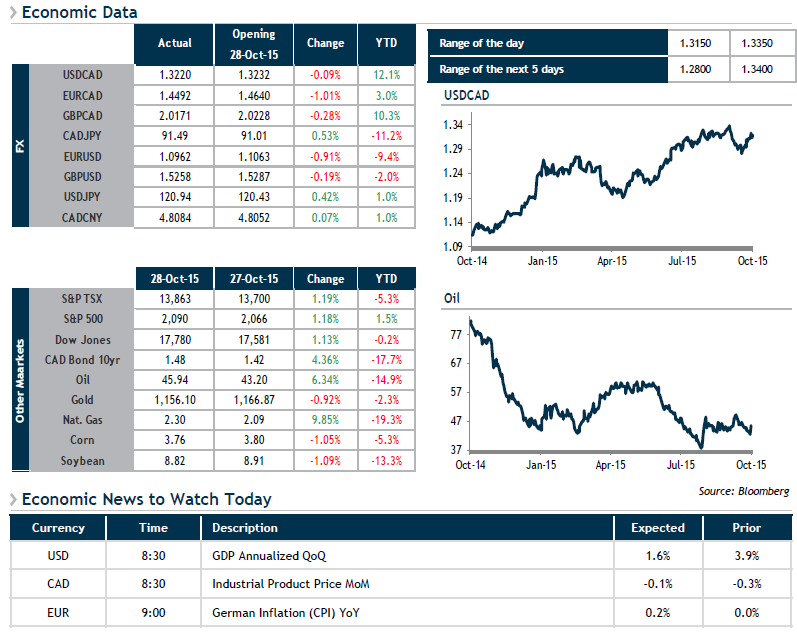

As soon as the Fed’s rate decision was announced, the U.S. Dollar Index (DXY), which measures the greenback against a basket of major currencies, gained close to 1.30%. The euro was the big loser, shedding -1.66% against the USD and -1.87% against the CAD.

A little earlier in the day, we saw an impressive rally by the loonie against the greenback (+1.4%), propelled by rising crude oil prices, which were up 5.5% based on Cushing inventory data that failed to match the forecast (3,376,000 barrels vs. 3,750,000 barrels).

At 8:30 this morning, we’ll be keeping a close eye on the release of the first Q3 2015 U.S. GDP estimate. The reading is expected to be up 1.6%.