Investing.com’s stocks of the week

All Eyes on the Fed at 2 p.m

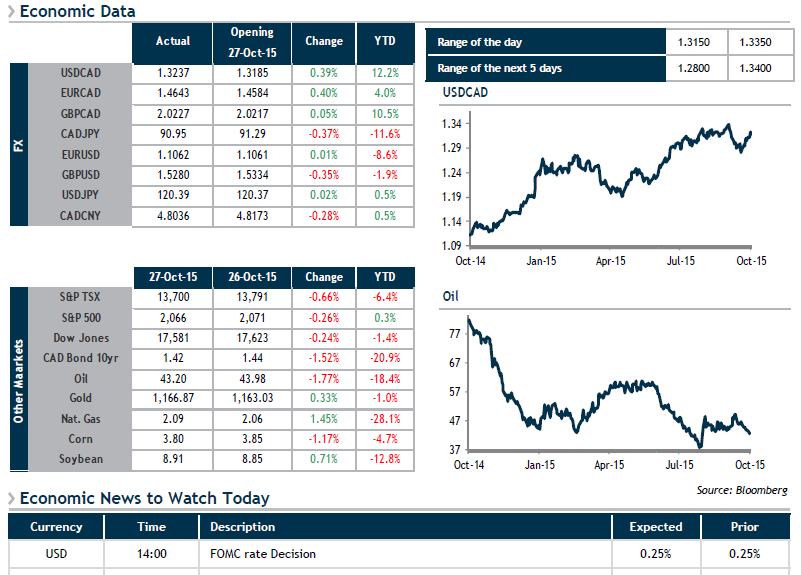

Markets are definitely eager to learn whether the Fed continues to think that it will be able to raise its key rate before the end of the year, which is now considered only 40% likely due to disappointing domestic economic indicators and serious difficulties at the moment in China, the world’s second largest economy. That being said, if the Fed does maintain its position in favour of a rate hike this year, we can expect a rising USD.

However, orders for non-defence capital goods (excluding civilian aircraft) released yesterday showed the negative impact that a strong greenback can have on U.S. manufacturers in a fragile global economy (low worldwide demand). They slipped -0.3% in September and August’s reading was also revised downward by -1.6% to the surprise of most observers.

Consumer Confidence was also down, at 97.6 vs. 103.0 the previous month, due mainly to the modest increase in salaries and a slowing in job creation over the past two months. In short, there’s a wealth of relevant information for the Fed to mull over.