Canadian inflation at 1% for Septyember

On Friday, we learned that the Canadian Consumer Price Index had risen less than expected in September or 1.0% vs. 1.1%, due to low energy prices and sluggish Canadian growth. If energy and food costs are removed from the calculation, core inflation has held steady this year at around 2.2%. The loonie nevertheless dipped close to 2% over the past week based on these developments, offering attractive protection levels for Canadian exporters.

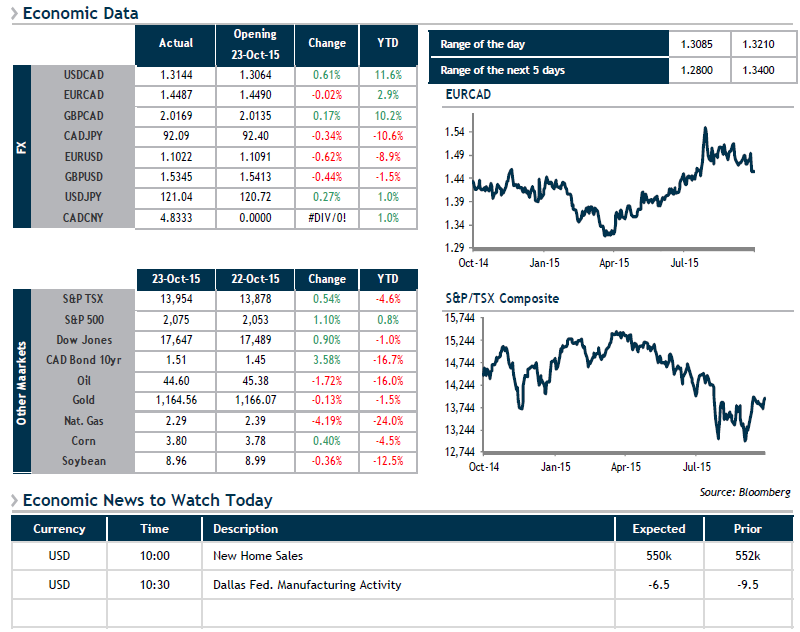

Our currency is not the only one to have lost ground against the greenback recently. Further to recent comments by the European Central Bank, the Bank of Japan and actions taken by the People’s Bank of China, the U.S. Dollar Index (DXY) has risen close to 2.72% against its major rivals. The euro, which had fallen substantially the previous week further to comments from ECB President Mario Draghi, is trading at levels not seen since mid-August.

We can expect another relatively volatile week with both the Bank of Japan and the Fed making monetary policy announcements on Wednesday.