Sustained Growth in China

The official data released by the National Bureau of Statistics last evening confirmed that the Chinese economy grew by 6.9% during Q3 of 2015. This exceeded market expectations of 6.8%, but was still the weakest performance since the start of 2009. In the end, it’s still an encouraging indicator that should reassure investors and maybe even the leaders of the Fed. The Australian dollar is the currency that has benefited the most from the news. As for the loonie, it has remained in the low end of the range in the past two weeks, despite the fact that crude oil prices are falling by 1% this morning.

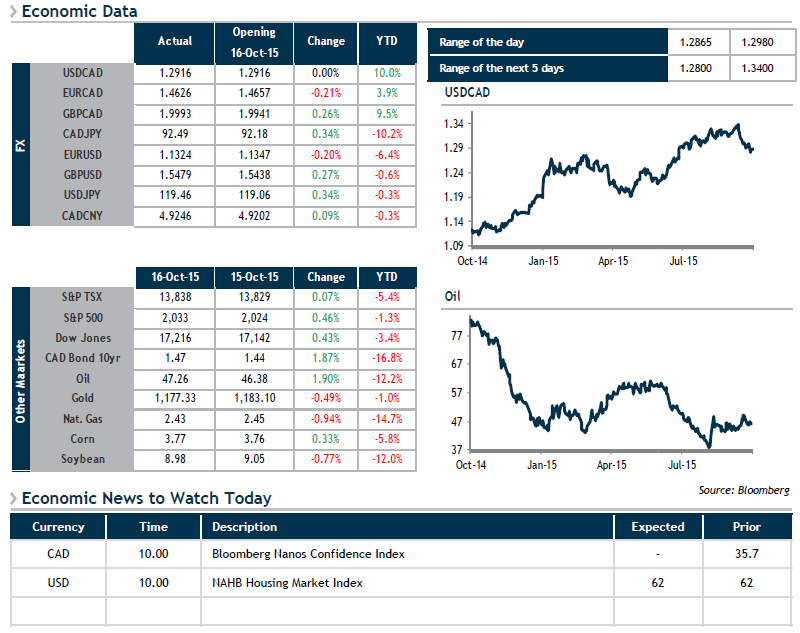

No noteworthy economic indicators will be released in North America this morning, except for the Nanos Canadian Confidence Index at 10 a.m. and the NAHB Housing Market Index in the U.S. We will also be keeping a very close eye on the Canadian electoral campaign this evening, to assess its impact on financial markets.