D-Day-1, the Fed begins its meeting

Economic indicators released yesterday provided little in the way of clear indications as to the health of the U.S. economy. August Retail Sales failed to meet expectations (+0.2% vs. +0.3%), as did Industrial Production (-0.4% vs. -0.2%). However, the same data for the previous month were revised upward, cancelling out the disappointing results for August.

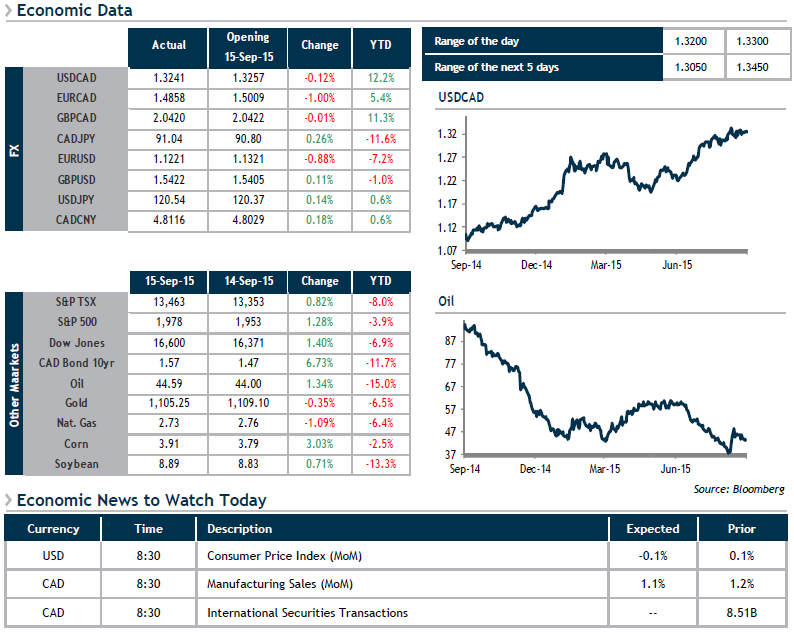

All in all, North American stock markets reacted positively, with the S&P500 up 1.28% and the TSX rising +0.85%. Oil also gained yesterday, with WTI climbing +1.22%, a trend that continued overnight with a +1.59% increase.

The euro nudged down -0.5% overnight as eurozone inflation for August came in even weaker than anticipated (+0.1% vs. +0.2% on an annualized basis). The greenback should continue to tread water against the loonie while we await the Fed’s key rate decision tomorrow, barring a surprise in U.S. inflation, which will be announced at 8:30 this morning.