Investing.com’s stocks of the week

Uncertain times in Canada

Not surprisingly, Statistics Canada confirmed that the country was in a technical recession yesterday, meaning that all is not totally doom and gloom, particularly the gains seen in exports and consumer spending. Canada’s economic future remains cloudy, however, for the remainder of the year given the challenges presented by low oil prices (Alberta has announced a deficit of close to $6 billion) and the drop in personal saving that is feeding into consumer spending at the expense of investments.

Although the announcement that negative economic growth was not as bad as expected proved initially favourable to the CAD, dropping crude oil prices quickly put the pressure back on. It’s hard to explain what’s happening with oil, which has gone from the “strongest surge in 25 years” to “the worst one-day plunge since February” in the space of 24 hours. If we really want to blame someone, we could point the finger at China and its contracting manufacturing sector for the troubles seen on stock markets and with oil.

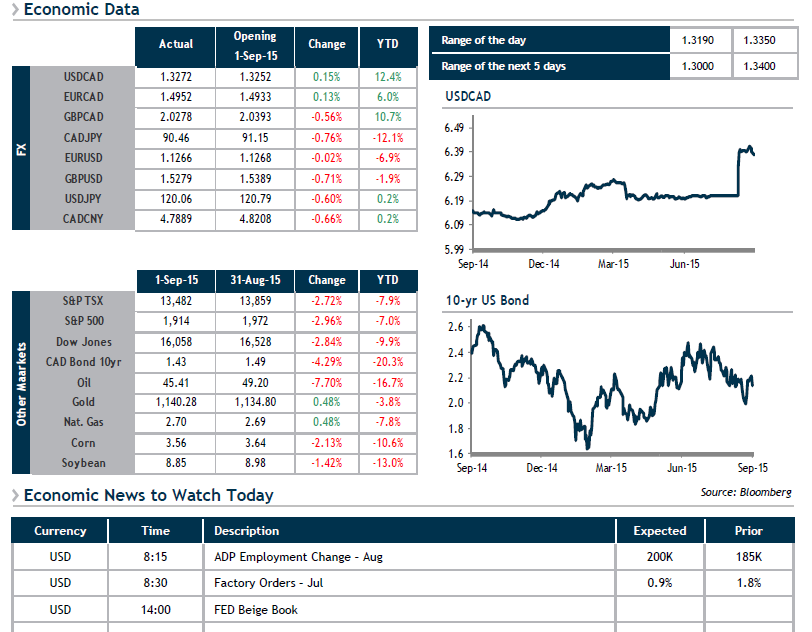

The only constant that remains is the major volatility that dominates all asset classes, illustrating how useful it is to have orders in place. This morning, we’ll be keeping an eye on ADP Employment Change numbers south of the border at 8:15, followed at 10:00 by Factory Orders.