Investing.com’s stocks of the week

OPEC ready to negotiate on its own terms OPEC appears to have taken a page out of the playbook of central bank officials, who use their public statements to influence currency prices and interest rates, in a bid to exert control over crude oil prices. With a goal of establishing a “fair” price, officials have invited all producers to sit down to talks, while specifying that they will nevertheless ensure their own interests are safeguarded. Combined with an announcement from the IEA, which anticipates a 130,000 barrel a day drop in U.S. output, the possibility of lower production from OPEC member nations fed into the rise in crude oil prices that began on Thursday. At its high point yesterday, oil hit 49.30 a barrel, curiously leading retailers to quickly adjust the price at the pump.

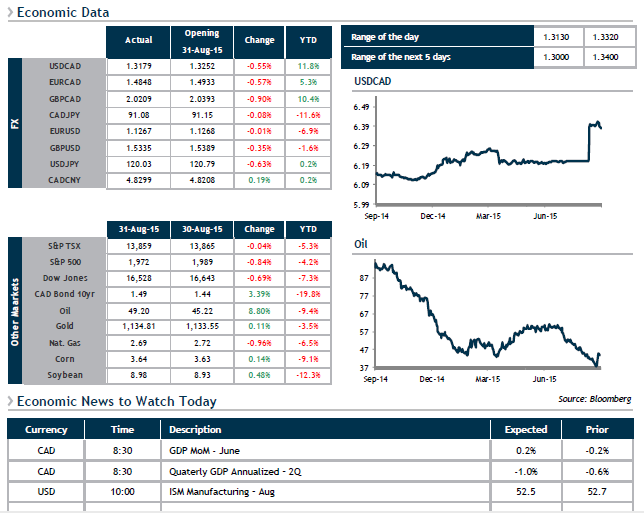

Our currency also was quick to react, soaring more than two cents against the greenback. The loonie has since seen its gains trimmed, but still presents somewhat of an opportunity. Canadian GDP figures slated for 8:30 this morning could rein in the CAD if a technical recession were confirmed for the country. Caution is key.