The U.S. Dollar Continues to Rise

The main factors that will captivate the attention of markets in the coming week are the yuan, commodity prices, inflation figures and the minutes of the latest FOMC meeting. It will also be interesting to monitor the comments made by two of the voting members of the Fed, who will be giving speeches in the coming days.

The release of the minutes of the FOMC meeting that was held on July 28 and 29 will fuel speculation on the moment chosen to raise the Fed’s key rate. The volatility arising from the yuan’s devaluation has lowered the possibility of a key rate hike by the U.S. Federal Reserve as of next September. Markets remain divided: the odds of an increase in September are forecast at 50% and an increase by the end of the year at 75%.

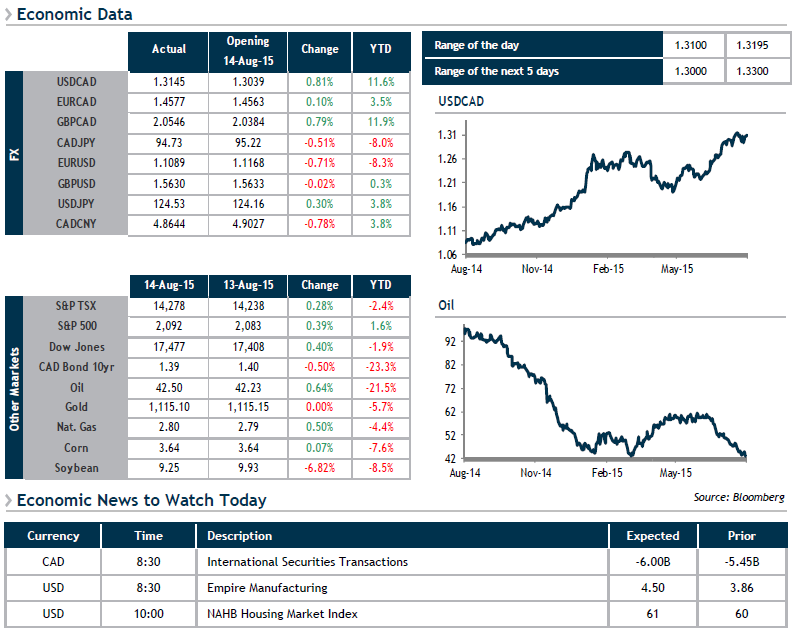

The yuan is relatively unchanged this morning, whereas the greenback is recording gains against most major currencies. Crude oil prices are continuing to fall, and Canadian and U.S. bond yields are also sliding.