Markets repositioning

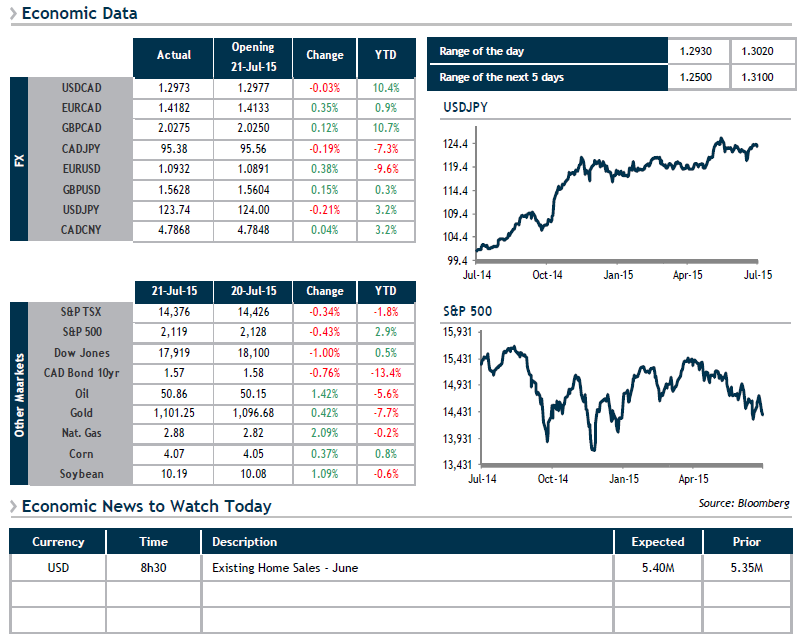

The lack of economic indicators of note in North America has brought a certain measure of calm to the rush toward the greenback, causing it to dip slightly against most other major currencies. Such a context would appear to lend itself well to market players calling into question the impact of sustained gains in the USD on the U.S. economy and by extension, on the Fed’s interest in tightening its monetary policy in the near future. The JPY and the euro have made out particularly well in this situation.

Quarterly earnings season is continuing and the mood is one of disappointment given the negative performance of major names such as IBM (NYSE:IBM), United Technologies (NYSE:UTX), Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL). North American stock indexes all closed in the red yesterday, with the Dow Jones giving up 1%. Asian markets appeared to follow suit when they opened, but have since been able to regain a substantial portion of the lost ground.

This morning, U.S. Existing Home Sales for June will be announced at 10 a.m. Then, at 5 p.m., the Reserve Bank of New Zealand will announce its key rate decision, with markets anticipating a 25-bp cut.