Investing.com’s stocks of the week

Commodities on the Decline

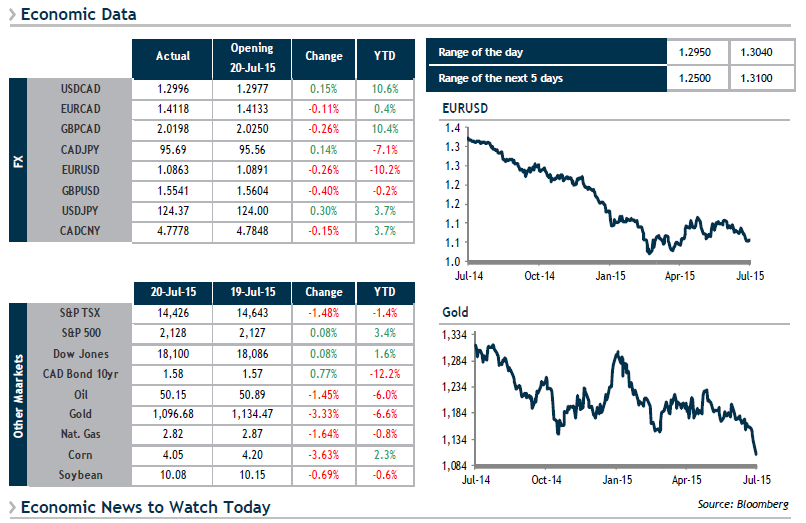

If nothing else, we can at least say that caution remains the watchword with regard to the euro, as both the announcement that banks in Greece were reopening and that the country was making a 6 billion Euro payment to the ECB and IMF went virtually unnoticed yesterday. It would appear that repaying a loan using another loan leaves observers to wonder about a country’s financial future.

Meanwhile, downward pressures on the loonie persist as commodity prices in general continue to slide. Crude oil fell briefly below the $50 a barrel threshold yesterday and is trading in the same range this morning. Gold has also been hard-hit, and has racked up losses of close to 5% since July 8. In short, the scenario lends further credence to the likelihood of additional losses by the CAD.

Across the pond, the United Kingdom announced its lowest budget deficit for any June since 2008 this morning (-£9.4 billion vs. -£10.2 billion the previous year) thanks to increased revenues from personal and corporate taxation.