The Bank of Canada Cuts Its Key Rate!

It would seem that the decision-makers at the Bank of Canada appreciate being in the spotlight. Yesterday, Governor Stephen Poloz announced a second cut to the key rate in the past 6 months, in order to inject an additional dose of adrenaline to the Canadian economy. The BoC justified its decision by pointing to the weak economic growth posted so far in 2015. From January to April, Canadian GDP recorded a drop. In all likelihood, weak energy prices are continuing to hurt investments and the forecasted growth in exports has failed to materialize. The BoC also lowered its growth forecasts for 2016. However, all is not bleak for Canada, as the job market continues to surprises analysts with its resiliency, and over the medium term, our economy should benefit from the economic expansion occurring in the United States.

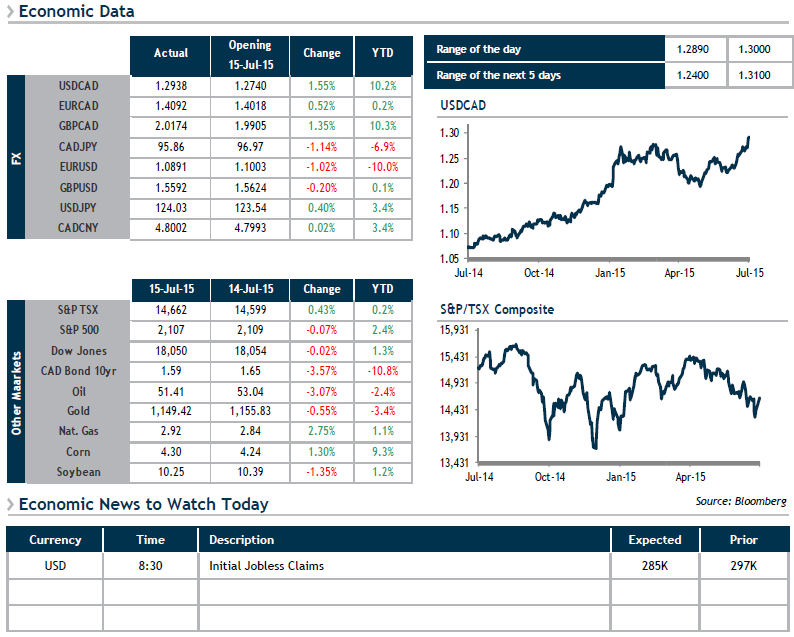

After the announcement the Canadian dollar moved substantially and reached the 1.30 levels, a level that hadn’t been reached since 2009. Given that the Fed is gearing up to increase its key rate, a gap between the Canadian and U.S. monetary policy would weigh down on the loonie even more.